"Top Loan Companies for People with Bad Credit: Your Ultimate Guide to Securing Funding"

Guide or Summary:IntroductionUnderstanding Bad CreditTypes of Loans AvailableHow to Choose the Right Loan CompanyImproving Your Chances of Approval**Transla……

Guide or Summary:

- Introduction

- Understanding Bad Credit

- Types of Loans Available

- How to Choose the Right Loan Company

- Improving Your Chances of Approval

**Translation of "loan companies for people with bad credit":** 贷款公司为信用不良的人士提供服务

---

Introduction

Finding financial assistance can be challenging, especially for individuals with bad credit. However, there are numerous loan companies for people with bad credit that cater specifically to those who may have faced financial difficulties in the past. This guide aims to provide you with essential information about these companies, the types of loans available, and how to improve your chances of approval.

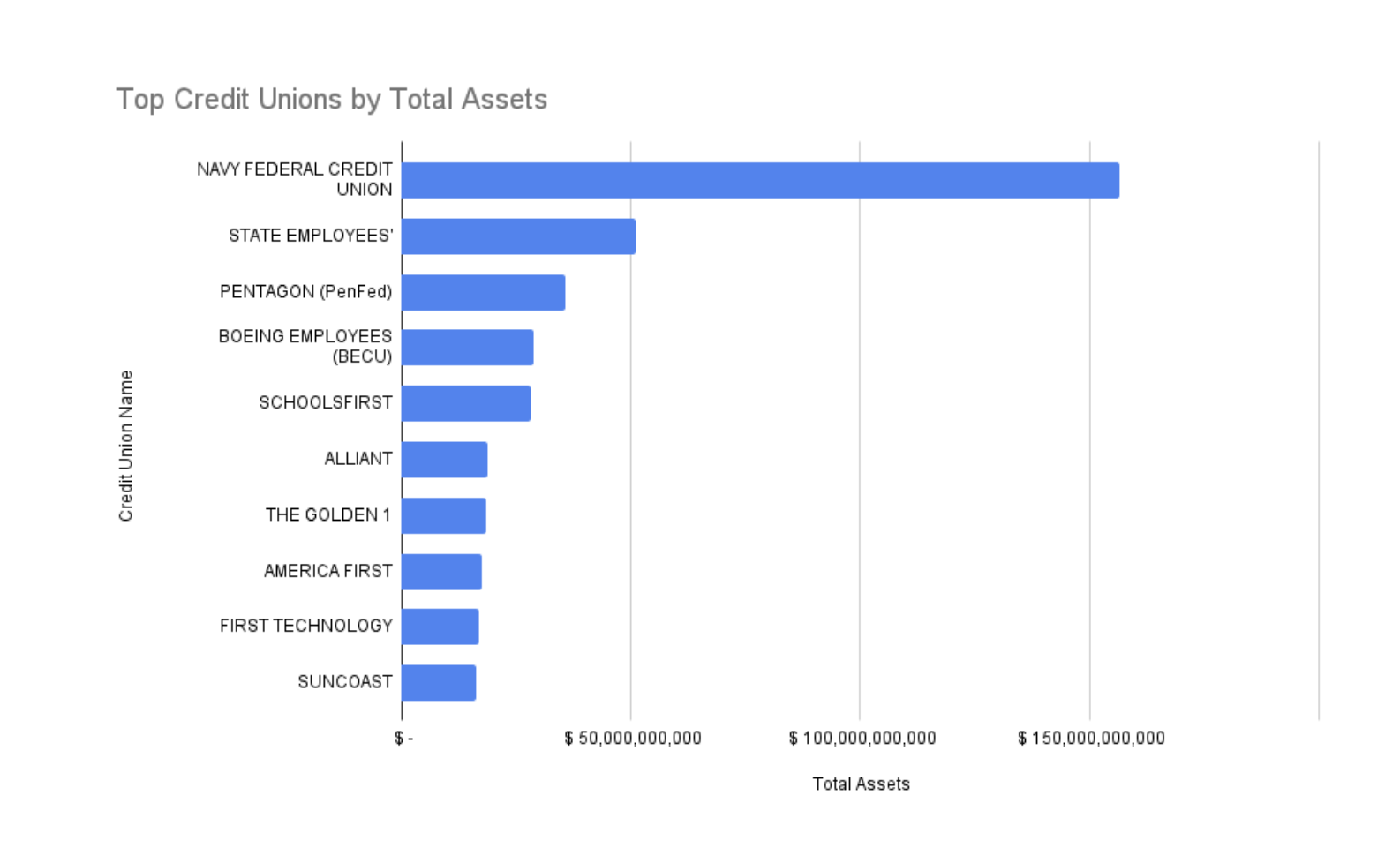

Understanding Bad Credit

Bad credit typically refers to a low credit score, which can result from missed payments, high debt levels, or bankruptcy. A poor credit history can make it difficult to secure traditional loans from banks and credit unions. Fortunately, loan companies for people with bad credit exist to provide alternative options.

Types of Loans Available

There are several types of loans offered by loan companies for people with bad credit. These include:

1. **Personal Loans**: Unsecured loans that can be used for any purpose, such as debt consolidation or emergency expenses.

2. **Payday Loans**: Short-term loans that are typically due on your next payday. While they are easy to obtain, they often come with high-interest rates.

3. **Title Loans**: Loans secured by the title of your vehicle. If you default, the lender can take possession of your car.

4. **Peer-to-Peer Loans**: Platforms that connect borrowers with individual investors willing to fund their loans.

How to Choose the Right Loan Company

When searching for loan companies for people with bad credit, consider the following factors:

- **Interest Rates**: Compare rates from different lenders to find the most affordable option.

- **Loan Terms**: Look for companies that offer flexible repayment terms that suit your financial situation.

- **Customer Reviews**: Research the lender’s reputation by reading customer reviews and testimonials.

- **Transparency**: Ensure the lender provides clear information about fees and terms before you commit.

Improving Your Chances of Approval

While loan companies for people with bad credit are more lenient with their requirements, there are steps you can take to improve your chances of getting approved:

1. **Check Your Credit Report**: Review your credit report for errors and dispute any inaccuracies.

2. **Provide Proof of Income**: Demonstrating a stable income can reassure lenders of your ability to repay the loan.

3. **Consider a Co-Signer**: Having a co-signer with good credit can increase your chances of approval and may result in better terms.

4. **Borrow Only What You Need**: Requesting a smaller loan amount can make it easier to get approved.

Securing a loan with bad credit may seem daunting, but there are many loan companies for people with bad credit ready to help. By understanding your options and taking proactive steps, you can find the financial support you need to move forward. Remember to research thoroughly, compare offers, and choose a lender that aligns with your financial goals. With the right approach, you can overcome your credit challenges and achieve financial stability.