Understanding ALPLN Loan Type: A Comprehensive Guide to Its Benefits and Features

Guide or Summary:ALPLN Loan Type refers to a specific category of loans designed to cater to particular financial needs and circumstances. The term "ALPLN……

Guide or Summary:

- ALPLN Loan Type refers to a specific category of loans designed to cater to particular financial needs and circumstances. The term "ALPLN" stands for "Alternative Lending Product Loan Network," which indicates a more flexible approach to lending compared to traditional methods. This type of loan is often sought by individuals or businesses that may not qualify for conventional loans due to various factors such as credit history, income level, or the nature of their financial requirements.

- Key Features of the ALPLN loan type include flexible qualification criteria, competitive interest rates, and a streamlined application process. Unlike traditional loans that might require extensive documentation and a lengthy approval period, ALPLN loans often prioritize the borrower's overall potential rather than just their credit score. This makes them an attractive option for those who may have had financial difficulties in the past.

- Benefits of opting for the ALPLN loan type are manifold. Firstly, borrowers can enjoy quicker access to funds, which is crucial for time-sensitive financial needs such as home repairs, medical expenses, or business investments. Additionally, the flexible repayment terms can be tailored to fit the borrower's financial situation, reducing the stress associated with monthly payments.

- Who Can Benefit from the ALPLN loan type? A wide range of individuals and businesses can take advantage of this lending option. For example, entrepreneurs seeking startup capital may find it challenging to secure funding through traditional banks. Similarly, individuals with less-than-perfect credit histories can still access necessary funds without facing exorbitant fees or interest rates.

- How to Apply for an ALPLN loan type is a straightforward process. Potential borrowers can typically begin by filling out an online application form, which may require basic personal information, financial details, and the amount they wish to borrow. After submission, lenders will review the application and may request additional documentation to assess the borrower's eligibility.

#### What is ALPLN Loan Type?

ALPLN Loan Type refers to a specific category of loans designed to cater to particular financial needs and circumstances. The term "ALPLN" stands for "Alternative Lending Product Loan Network," which indicates a more flexible approach to lending compared to traditional methods. This type of loan is often sought by individuals or businesses that may not qualify for conventional loans due to various factors such as credit history, income level, or the nature of their financial requirements.

#### Key Features of ALPLN Loan Type

Key Features of the ALPLN loan type include flexible qualification criteria, competitive interest rates, and a streamlined application process. Unlike traditional loans that might require extensive documentation and a lengthy approval period, ALPLN loans often prioritize the borrower's overall potential rather than just their credit score. This makes them an attractive option for those who may have had financial difficulties in the past.

#### Benefits of Choosing ALPLN Loan Type

Benefits of opting for the ALPLN loan type are manifold. Firstly, borrowers can enjoy quicker access to funds, which is crucial for time-sensitive financial needs such as home repairs, medical expenses, or business investments. Additionally, the flexible repayment terms can be tailored to fit the borrower's financial situation, reducing the stress associated with monthly payments.

Moreover, the ALPLN loan type often provides a more personalized lending experience. Lenders in this network are typically more willing to work with borrowers to find a solution that meets their specific needs. This level of customer service can be a significant advantage for those who feel overwhelmed by the impersonal nature of traditional banking.

#### Who Can Benefit from ALPLN Loan Type?

Who Can Benefit from the ALPLN loan type? A wide range of individuals and businesses can take advantage of this lending option. For example, entrepreneurs seeking startup capital may find it challenging to secure funding through traditional banks. Similarly, individuals with less-than-perfect credit histories can still access necessary funds without facing exorbitant fees or interest rates.

Additionally, those looking to consolidate debt may also benefit from the ALPLN loan type. By combining multiple high-interest debts into a single, more manageable loan, borrowers can save money and simplify their financial obligations.

#### How to Apply for ALPLN Loan Type

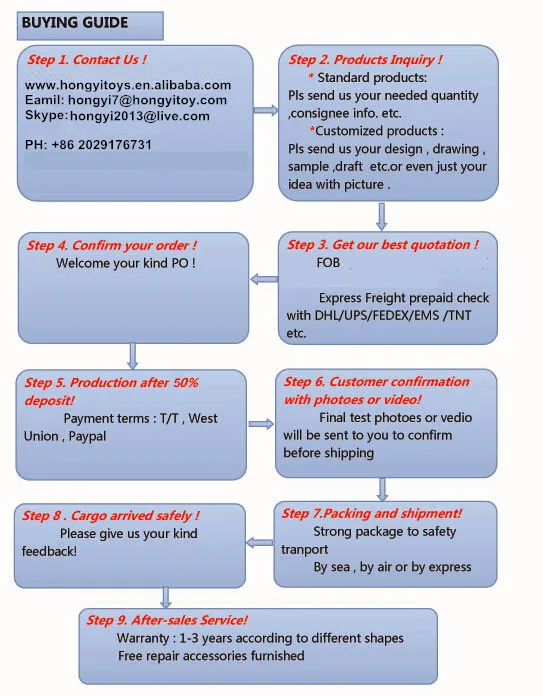

How to Apply for an ALPLN loan type is a straightforward process. Potential borrowers can typically begin by filling out an online application form, which may require basic personal information, financial details, and the amount they wish to borrow. After submission, lenders will review the application and may request additional documentation to assess the borrower's eligibility.

Once approved, borrowers can expect to receive their funds relatively quickly, often within a few days. This rapid turnaround time is one of the main draws of the ALPLN loan type, making it an ideal choice for those in urgent need of financial assistance.

#### Conclusion

In summary, the ALPLN loan type offers a viable alternative for individuals and businesses seeking financial support outside the traditional banking system. With its flexible terms, quicker access to funds, and personalized service, the ALPLN loan type stands out as a favorable option for a variety of financial situations. Whether you are looking to invest in your business, manage unexpected expenses, or consolidate debt, exploring the ALPLN loan type could be a beneficial step towards achieving your financial goals.