Unlock the Value of Your Gold: Discover the Best Gold Loan Per Gram Rates Today!

#### IntroductionIn today's fast-paced financial world, many individuals are seeking quick and reliable ways to access cash without the hassle of lengthy lo……

#### Introduction

In today's fast-paced financial world, many individuals are seeking quick and reliable ways to access cash without the hassle of lengthy loan processes. One of the most effective solutions is leveraging your valuable gold assets. Understanding the concept of **gold loan per gram** is essential for anyone considering this financial option. This article will delve into the intricacies of gold loans, how they work, and why they might be the perfect solution for your immediate financial needs.

#### What is a Gold Loan?

A gold loan is a secured loan where borrowers pledge their gold jewelry or ornaments as collateral to obtain funds from a financial institution. The loan amount is typically determined based on the current market value of the gold, with lenders offering a specific rate per gram. This brings us to the critical metric of **gold loan per gram**, which varies from lender to lender and is influenced by several factors including the purity of gold, market demand, and the overall economic climate.

#### Understanding Gold Loan Per Gram

When you approach a lender for a gold loan, they will evaluate your gold and provide you with a loan amount based on its weight and purity. The **gold loan per gram** rate is crucial as it directly affects how much money you can borrow. For example, if the lender offers a rate of $50 per gram and you have 100 grams of gold, you could potentially secure a loan of $5,000. This makes it vital to shop around and compare rates from different financial institutions to ensure you get the best deal.

#### Factors Influencing Gold Loan Rates

Several factors can influence the **gold loan per gram** rate:

1. **Purity of Gold**: The higher the purity, the more valuable your gold is. Most lenders prefer 22K or 24K gold, which typically fetches a higher loan amount per gram.

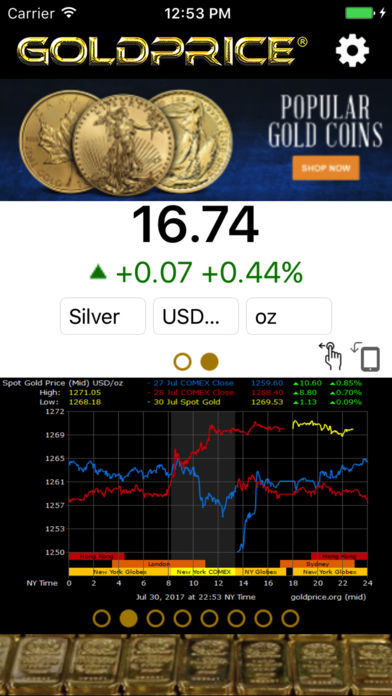

2. **Market Trends**: Gold prices fluctuate based on market conditions. Keeping an eye on gold price trends can help you time your loan effectively.

3. **Lender Policies**: Different lenders have varying policies regarding gold loans. Some may offer more competitive rates than others, so it's worth doing your research.

4. **Loan Tenure**: The duration for which you intend to take the loan can also affect the interest rate and overall terms. Shorter loan tenures may offer better rates.

#### Benefits of Gold Loans

Gold loans come with several advantages:

- **Quick Processing**: Unlike traditional loans, gold loans can be processed quickly, often within a few hours. This is ideal for urgent financial needs.

- **No Credit Checks**: Since gold loans are secured against your assets, lenders typically do not require credit checks, making it accessible even for those with poor credit history.

- **Flexible Repayment Options**: Many lenders offer flexible repayment plans, allowing you to choose a tenure that suits your financial situation.

#### Conclusion

In conclusion, understanding the **gold loan per gram** rate is crucial for anyone considering a gold loan. By leveraging your gold assets, you can secure quick financing without the need for extensive paperwork or credit checks. As you explore your options, remember to compare rates from various lenders to ensure you receive the best possible deal. Whether you need funds for an emergency, education, or a business opportunity, a gold loan can provide a reliable solution while allowing you to retain ownership of your valuable gold. Take the first step towards unlocking the value of your gold today!