Unlock Your Financial Future: Discover the Best 450 Credit Score Personal Loan Options Today!

In today’s financial landscape, having a less-than-perfect credit score can feel like a roadblock to accessing essential funds. However, if you have a 450 c……

In today’s financial landscape, having a less-than-perfect credit score can feel like a roadblock to accessing essential funds. However, if you have a 450 credit score personal loan in mind, you’re not alone. Many individuals find themselves in similar situations and are searching for viable options to improve their financial standing. This article will explore the best strategies for obtaining a 450 credit score personal loan, the benefits of these loans, and how they can help you regain control of your finances.

#### Understanding Your Credit Score

Before diving into the specifics of a 450 credit score personal loan, it’s crucial to understand what a credit score represents. Credit scores typically range from 300 to 850, and a score of 450 is considered very poor. This score can result from various factors, including missed payments, high credit utilization, and a lack of credit history. Lenders view a low credit score as a risk, making it challenging to secure traditional loans. However, there are still options available for those with a 450 credit score personal loan.

#### Exploring Loan Options

When searching for a 450 credit score personal loan, consider the following options:

1. **Credit Unions**: Many credit unions offer personal loans to their members, often with more lenient credit requirements compared to traditional banks. If you’re a member of a credit union, inquire about their personal loan offerings.

2. **Peer-to-Peer Lending**: Platforms like LendingClub and Prosper allow individuals to borrow money directly from other individuals. These platforms often consider your overall financial situation rather than just your credit score.

3. **Secured Loans**: If you have assets such as a car or savings account, you might consider a secured personal loan. By backing the loan with collateral, lenders may be more willing to approve your application despite your low credit score.

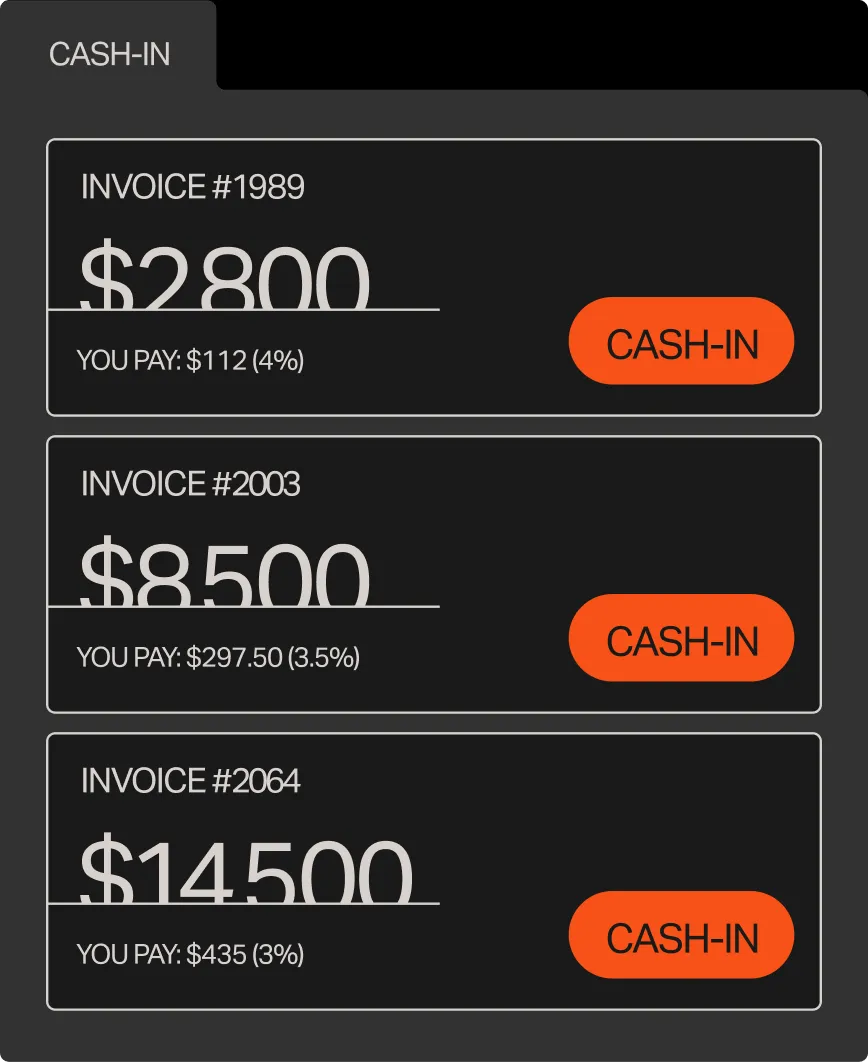

4. **Alternative Lenders**: Some online lenders specialize in providing loans to individuals with poor credit. While interest rates may be higher, these loans can provide the funds you need to address immediate financial concerns.

#### Benefits of a Personal Loan with a Low Credit Score

Acquiring a 450 credit score personal loan may seem daunting, but there are several benefits to consider:

- **Debt Consolidation**: If you’re struggling with multiple debts, a personal loan can help consolidate them into a single monthly payment, often at a lower interest rate.

- **Emergency Expenses**: Life is unpredictable, and having access to funds for unexpected expenses can provide peace of mind and financial stability.

- **Credit Score Improvement**: By responsibly managing a personal loan and making timely payments, you can gradually improve your credit score over time.

#### Tips for Securing a 450 Credit Score Personal Loan

To increase your chances of approval for a 450 credit score personal loan, consider these tips:

- **Research Lenders**: Take the time to compare different lenders and their requirements. Look for those that specialize in loans for individuals with poor credit.

- **Prepare Documentation**: Gather all necessary documentation, including proof of income, employment history, and any other financial information that can support your application.

- **Consider a Co-Signer**: If possible, having a co-signer with a better credit score can significantly improve your chances of loan approval.

- **Be Realistic About Loan Amounts**: While you may need a substantial amount, requesting a smaller loan can increase your chances of approval.

In conclusion, securing a 450 credit score personal loan is not impossible. With the right strategy, research, and preparation, you can find a loan that meets your needs and helps you pave the way to a brighter financial future. Don’t let a low credit score hold you back—explore your options today!