How Do I Get a Student Loan with No Credit? Unlocking Financial Opportunities for Students

#### IntroductionNavigating the world of student loans can be daunting, especially if you have no credit history. Many students find themselves asking, **ho……

#### Introduction

Navigating the world of student loans can be daunting, especially if you have no credit history. Many students find themselves asking, **how do I get a student loan with no credit?** Fortunately, there are options available that can help you secure the funding you need to pursue your education. In this article, we will explore various strategies, tips, and resources to help you obtain a student loan without a credit history.

#### Understanding Student Loans

Before diving into the specifics of obtaining a student loan with no credit, it’s essential to understand the different types of student loans available. Federal student loans are typically more accessible and come with lower interest rates compared to private loans. They also offer flexible repayment options, making them a favorable choice for many students.

#### How Do I Get a Student Loan with No Credit?

1. **Federal Student Loans**: One of the best options for students with no credit history is federal student loans. These loans do not require a credit check, making them accessible to all students, regardless of their credit status. To apply for federal student loans, you must complete the Free Application for Federal Student Aid (FAFSA). Ensure you submit your FAFSA as early as possible to maximize your chances of receiving financial aid.

2. **Subsidized vs. Unsubsidized Loans**: When applying for federal student loans, you may encounter subsidized and unsubsidized loans. Subsidized loans are based on financial need, and the government pays the interest while you are in school. Unsubsidized loans, on the other hand, accrue interest from the moment they are disbursed. Understanding the differences between these two types of loans can help you make informed decisions about your borrowing.

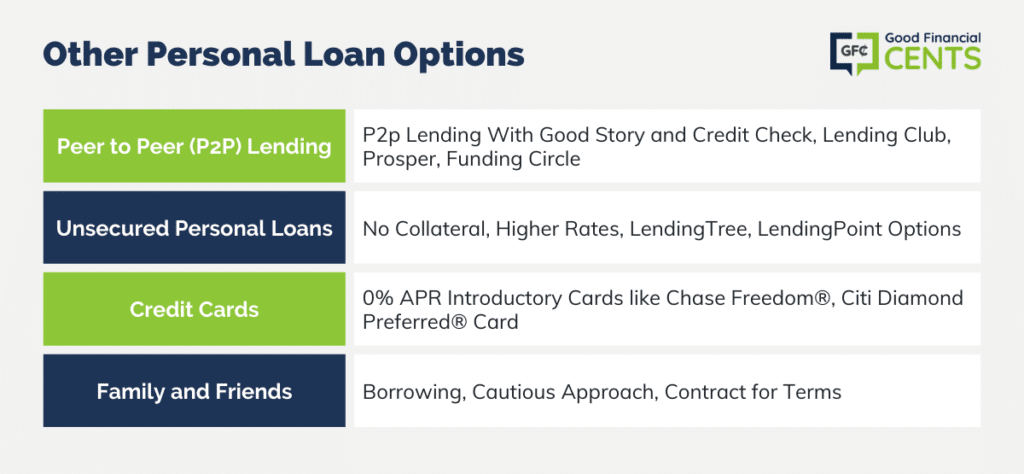

3. **Private Student Loans with a Co-signer**: If federal loans do not cover your entire educational expenses, you may consider private student loans. Many private lenders require a credit check, but having a co-signer with good credit can significantly increase your chances of approval. A co-signer agrees to take responsibility for the loan if you default, which reduces the risk for the lender.

4. **Credit Unions and Community Banks**: Some local credit unions and community banks offer student loans with more lenient credit requirements. These institutions may be more willing to work with students who have no credit history. It’s worth researching local options and speaking with a loan officer to explore your possibilities.

5. **Scholarships and Grants**: While not a loan, scholarships and grants are excellent ways to fund your education without incurring debt. Many organizations offer financial aid based on merit or need. Research various scholarship opportunities and apply to as many as you can to supplement your education costs.

6. **Building Credit While in School**: If you have time before you need to apply for loans, consider building your credit. You can do this by opening a secured credit card, making small purchases, and paying off the balance in full each month. Establishing a positive credit history can improve your chances of securing private loans in the future.

#### Conclusion

In conclusion, if you find yourself asking, **how do I get a student loan with no credit?** remember that there are several pathways available to you. Start by exploring federal student loans, as they are the most accessible option for students without a credit history. Additionally, consider private loans with a co-signer and seek out local credit unions that may have more flexible requirements. Lastly, don’t forget to explore scholarships and grants to help fund your education. With determination and the right resources, you can successfully secure the financial support you need to achieve your academic goals.