Unlock Your Financial Potential with VyStar Personal Loan Credit Score

Guide or Summary:What is a VyStar Personal Loan Credit Score?Why is Your VyStar Personal Loan Credit Score Important?How to Improve Your VyStar Personal Loa……

Guide or Summary:

- What is a VyStar Personal Loan Credit Score?

- Why is Your VyStar Personal Loan Credit Score Important?

- How to Improve Your VyStar Personal Loan Credit Score

Are you looking to secure a personal loan that meets your financial needs? Understanding your VyStar personal loan credit score is crucial to unlocking the best loan options available to you. In this comprehensive guide, we will delve into the significance of your credit score, how it affects your loan application process, and tips on improving it to ensure you get the most favorable terms on your VyStar personal loan.

What is a VyStar Personal Loan Credit Score?

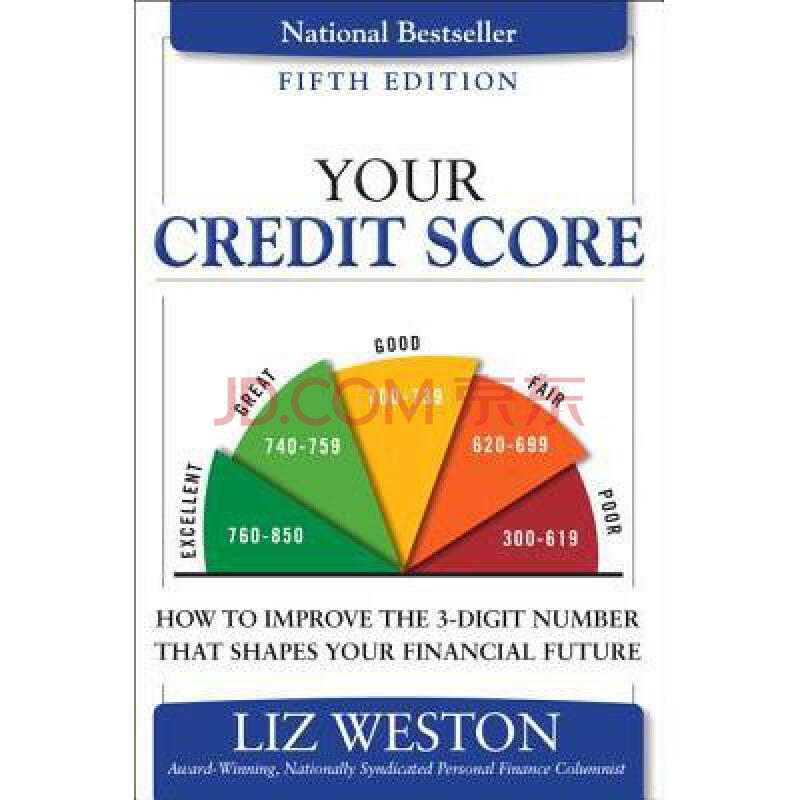

Your credit score is a numerical representation of your creditworthiness, calculated based on your credit history. VyStar Credit Union, like many lenders, uses this score to assess the risk of lending you money. A higher credit score indicates that you are a responsible borrower, while a lower score may suggest potential risks for the lender.

When applying for a VyStar personal loan, your credit score plays a pivotal role in determining not only your eligibility but also the interest rates and terms you will receive. Generally, borrowers with a score of 700 or above are considered to have good credit, which can lead to lower interest rates and better loan conditions.

Why is Your VyStar Personal Loan Credit Score Important?

1. **Loan Approval**: A good credit score significantly increases your chances of getting approved for a personal loan. VyStar, like other financial institutions, prefers lending to individuals with a solid credit history.

2. **Interest Rates**: Your credit score directly impacts the interest rates offered to you. A higher score can save you hundreds, if not thousands, of dollars over the life of the loan.

3. **Loan Amounts**: With a strong credit score, you may qualify for larger loan amounts, allowing you to cover significant expenses such as home renovations, medical bills, or debt consolidation.

4. **Loan Terms**: A favorable credit score can also lead to more flexible repayment terms, giving you the freedom to choose a plan that best fits your financial situation.

How to Improve Your VyStar Personal Loan Credit Score

Improving your credit score takes time and effort, but the rewards are well worth it. Here are some effective strategies to boost your VyStar personal loan credit score:

1. **Check Your Credit Report**: Regularly review your credit report for errors or inaccuracies. Dispute any discrepancies you find, as they can negatively affect your score.

2. **Pay Your Bills on Time**: Consistently paying your bills on time is one of the most significant factors influencing your credit score. Set up reminders or automatic payments to ensure you never miss a due date.

3. **Reduce Credit Card Balances**: Aim to keep your credit utilization ratio below 30%. Paying down existing credit card balances can have a positive impact on your score.

4. **Limit New Credit Applications**: Each time you apply for credit, a hard inquiry is made on your report, which can temporarily lower your score. Limit applications to only what you need.

5. **Maintain Old Accounts**: The length of your credit history also matters. Keep older accounts open, even if you don’t use them frequently, to help improve your score.

Your VyStar personal loan credit score is a vital component in your journey to secure a personal loan. By understanding its importance and taking proactive steps to improve it, you can unlock better loan options, lower interest rates, and more favorable terms. Whether you’re looking to consolidate debt, fund a major purchase, or cover unexpected expenses, a strong credit score can make all the difference. Start taking control of your financial future today by monitoring and improving your credit score, and watch as your loan possibilities expand.