Simple Loan Repayment Calculator: Your Guide to Managing Loans Effectively

In today's fast-paced world, managing personal finances can often feel overwhelming, especially when it comes to loans. Whether you're considering a mortgag……

In today's fast-paced world, managing personal finances can often feel overwhelming, especially when it comes to loans. Whether you're considering a mortgage, a personal loan, or a car loan, understanding how to effectively manage your repayments is crucial. This is where a simple loan repayment calculator comes into play. This tool can help you visualize your repayment schedule, understand interest costs, and ultimately, make informed financial decisions.

### What is a Simple Loan Repayment Calculator?

A simple loan repayment calculator is an online tool designed to help borrowers estimate their monthly loan payments based on several key factors: the loan amount, interest rate, and loan term. By inputting these variables, you can gain insights into how much you'll need to pay each month and how long it will take to pay off the loan.

### Why Use a Simple Loan Repayment Calculator?

1. **Budgeting Made Easy**: One of the primary benefits of using a simple loan repayment calculator is that it allows you to factor loan repayments into your monthly budget. Knowing how much you'll owe each month helps you allocate your finances accordingly, ensuring you live within your means.

2. **Understanding Interest Costs**: Loans often come with varying interest rates, and these can significantly affect your total repayment amount. A simple loan repayment calculator can break down how much of your monthly payment goes toward interest versus the principal amount, providing a clearer picture of your financial obligations.

3. **Comparison Shopping**: If you're considering multiple loan options, a simple loan repayment calculator can help you compare different loans side by side. By adjusting the loan amount, interest rate, and term, you can see which option is the most cost-effective, allowing you to make a more informed choice.

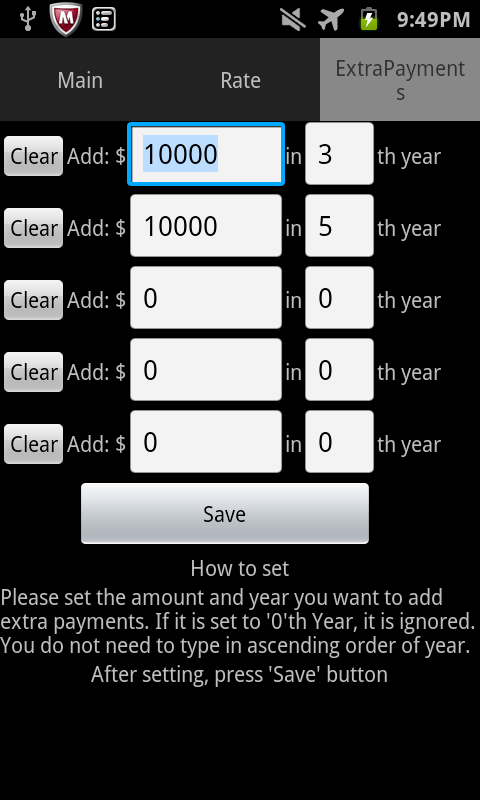

4. **Goal Setting**: If you're looking to pay off your loan faster, a simple loan repayment calculator can help you set realistic goals. By adjusting the repayment term or making extra payments, you can see how these changes affect your overall repayment timeline and interest costs.

5. **Reducing Financial Stress**: Understanding your financial commitments can significantly reduce anxiety. A simple loan repayment calculator provides clarity, allowing you to plan for the future without the fear of unexpected costs.

### How to Use a Simple Loan Repayment Calculator

Using a simple loan repayment calculator is straightforward. Here’s a step-by-step guide:

1. **Input Your Loan Amount**: Start by entering the total amount you wish to borrow.

2. **Enter the Interest Rate**: Input the annual interest rate associated with your loan. This is usually expressed as a percentage.

3. **Select the Loan Term**: Choose the duration over which you plan to repay the loan. This can range from a few months to several years.

4. **Calculate**: Once you've entered all the necessary information, click the calculate button. The calculator will provide you with your estimated monthly payments, total repayment amount, and total interest paid over the life of the loan.

### Conclusion

In conclusion, a simple loan repayment calculator is an invaluable tool for anyone considering taking out a loan. It not only simplifies the process of understanding loan repayments but also empowers you to make informed financial decisions. By leveraging this tool, you can take control of your finances, ensuring that you can manage your loans effectively and reduce the stress associated with debt.

Whether you're a first-time borrower or someone looking to refinance an existing loan, utilizing a simple loan repayment calculator is a step in the right direction. It’s more than just numbers; it’s about understanding your financial future and making choices that align with your personal goals. As you navigate the world of loans, remember that knowledge is power, and a simple loan repayment calculator is a great starting point in your financial journey.