Loan People with Good Credit: How to Maximize Your Loan Potential

Guide or Summary:Loan PeopleLoan People: A Comprehensive Guide to Navigating the Lending Landscape with Good CreditUnderstanding Your Credit ScoreExploring……

Guide or Summary:

- Loan PeopleLoan People: A Comprehensive Guide to Navigating the Lending Landscape with Good Credit

- Understanding Your Credit Score

- Exploring Loan Options

- Preparing for Loan Applications

- Maximizing Your Loan Potential

Loan PeopleLoan People: A Comprehensive Guide to Navigating the Lending Landscape with Good Credit

In the ever-evolving financial world, securing a loan is a pivotal step for both personal and professional growth. Whether you're aiming to purchase a home, finance a business venture, or undertake significant personal projects, the ability to access credit efficiently and effectively can be the difference between success and stagnation. This guide is designed for those savvy "loan people" who understand the power of good credit and are determined to maximize their loan potential.

Understanding Your Credit Score

The foundation of your loan journey lies in your credit score. A solid credit score not only reflects your financial reliability but also opens doors to more favorable loan terms, including lower interest rates and better repayment terms. Understanding the factors that influence your credit score is crucial. These include:

- Payment history: A consistent track record of making payments on time showcases your reliability.

- Credit utilization: Keeping your credit card balances low relative to your credit limits demonstrates responsible credit management.

- Length of credit history: Established credit accounts contribute positively to your credit score, as they provide a long-term record of financial responsibility.

- Credit mix: Diversifying your credit types (e.g., credit cards, auto loans, mortgages) can enhance your credit profile.

- New credit: Frequent applications for credit can temporarily lower your score, so managing new credit inquiries wisely is key.

By monitoring these elements, you can proactively manage your credit score, ensuring it remains a strong asset in your quest for loans.

Exploring Loan Options

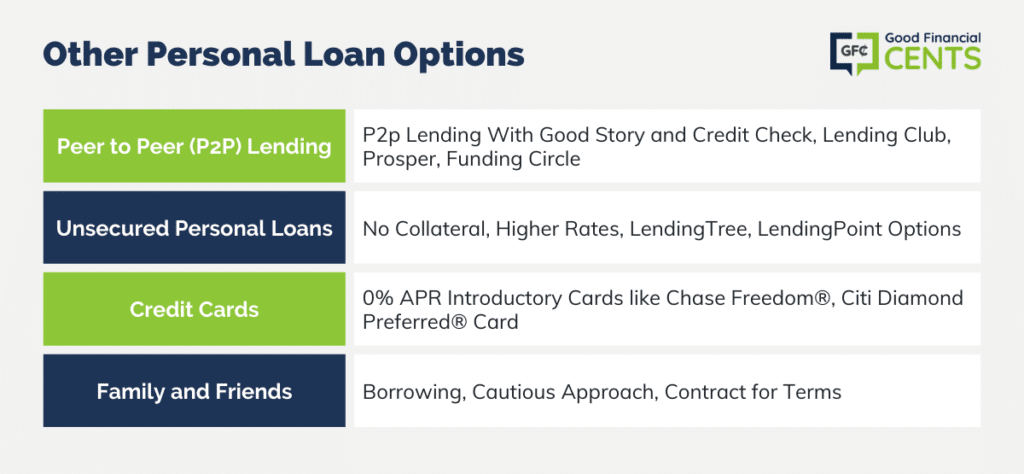

With a solid credit score in hand, the next step is to explore the diverse landscape of loan options available. Here are some key considerations:

- Personal loans: Offering flexibility and tailored repayment terms, personal loans are ideal for covering unexpected expenses or funding personal projects.

- Auto loans: Financing a vehicle not only provides transportation but also builds equity over time.

- Home loans: Whether you're buying a new home or refinancing an existing mortgage, securing the right loan can significantly impact your financial future.

- Business loans: For entrepreneurs and business owners, access to credit is essential for growth and expansion.

Each loan type comes with its own set of requirements, benefits, and drawbacks. Understanding these nuances is vital for selecting the loan that best aligns with your financial goals.

Preparing for Loan Applications

Preparation is key when applying for loans. Here are some essential steps to ensure a smooth and successful application process:

- Gather documentation: Collect all necessary financial documents, including bank statements, tax returns, and employment records.

- Assess your financial situation: Evaluate your income, expenses, and overall financial stability to determine how much you can afford to borrow.

- Shop around: Compare loan offers from different lenders to find the best terms and rates.

- Consider pre-approval: Securing pre-approval for a loan can demonstrate your financial readiness to lenders and may even improve your loan terms.

By taking these steps, you can position yourself as a desirable borrower, increasing your chances of securing favorable loan terms.

Maximizing Your Loan Potential

Finally, maximizing your loan potential involves strategic planning and continuous financial management. Here are some key strategies:

- Build and maintain a strong credit profile: Continuously monitor your credit score and take steps to improve it, if necessary.

- Diversify your credit portfolio: While managing existing credit responsibly, explore new loan opportunities to broaden your financial options.

- Stay informed: Keep abreast of changes in lending regulations and market conditions to make informed decisions about your loans.

- Seek professional advice: Consider consulting with financial advisors or loan officers to navigate the complexities of the lending landscape.

In conclusion, being a "loan person" with good credit is a powerful asset that can unlock numerous financial opportunities. By understanding your credit score, exploring loan options, preparing for applications, and maximizing your loan potential, you can navigate the lending landscape with confidence and achieve your financial goals. Remember, the key to successful loan management lies in knowledge, preparation, and strategic planning. With these tools at your disposal, you're well on your way to becoming a master of the lending world.