Student Loan Debt Strategies for Reducing and Managing

Guide or Summary:Title: "Mastering Your Student Loan Debt: A Comprehensive Guide to Reducing and Managing Your Financial Burden"Understanding the Scope of S……

Guide or Summary:

- Title: "Mastering Your Student Loan Debt: A Comprehensive Guide to Reducing and Managing Your Financial Burden"

- Understanding the Scope of Student Loan Debt

- Strategies for Reducing Student Loan Debt

- Effective Strategies for Managing Student Loan Debt

Title: "Mastering Your Student Loan Debt: A Comprehensive Guide to Reducing and Managing Your Financial Burden"

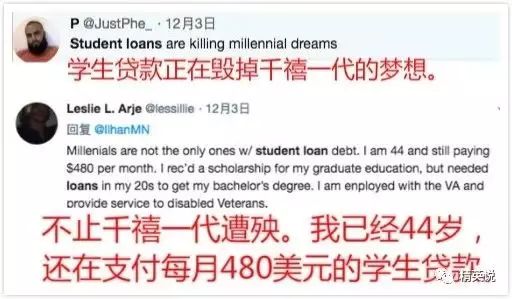

In the pursuit of higher education, many students embark on a journey that often leads to a significant financial commitment—the dreaded student loan debt. With tuition costs skyrocketing, the burden of repaying these loans can seem insurmountable. However, by adopting strategic approaches to managing and reducing student loan debt, students can navigate this financial labyrinth with confidence and ease.

Understanding the Scope of Student Loan Debt

To effectively tackle student loan debt, it is crucial first to comprehend its scale. As of recent data, the total outstanding student loan debt in the United States has surpassed $1.7 trillion, with millions of borrowers grappling with the long-term implications of their education financing. This staggering figure underscores the imperative need for proactive strategies aimed at mitigating the financial strain associated with student loans.

Strategies for Reducing Student Loan Debt

1. **Maximize Federal Student Aid**: Leveraging federal student aid programs, such as Pell Grants, Work-Study, and Direct Subsidized Loans, can significantly reduce the amount of debt accrued. Applying for these resources promptly and thoroughly can ensure that students secure the maximum possible financial assistance.

2. **Choose Wisely: Selecting Affordable Colleges**: Opting for colleges with affordable tuition fees can markedly decrease the overall cost of education. Additionally, considering community colleges for the first two years before transferring to a four-year institution can save on tuition expenses.

3. Graduate Early or Take On Part-Time Work: Graduating early or pursuing part-time work during college can accelerate the repayment of student loans. By reducing the duration of one's education or supplementing income through part-time jobs, students can pay off their loans more rapidly, thereby minimizing the total amount of interest paid over time.

4. **Explore Loan Forgiveness Programs**: Various loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, offer a path to debt relief for those engaged in specific professions or who have dedicated a portion of their careers to public service.

Effective Strategies for Managing Student Loan Debt

1. **Develop a Repayment Plan**: Creating a clear and actionable repayment plan is essential for managing student loan debt. This plan should outline the repayment strategy, including the selection of repayment plans such as income-driven repayment plans or the standard repayment plan, based on individual financial circumstances.

2. **Prioritize High-Interest Debt**: When managing multiple loans, it is prudent to prioritize paying off high-interest debt first. By doing so, students can reduce the overall interest paid and accelerate the repayment process.

3. Utilize Loan Refinancing for Lower Interest Rates: Exploring loan refinancing options can provide access to lower interest rates, making it easier to manage and repay student loans. This strategy can be particularly beneficial for those with good credit scores and stable income levels.

4. **Stay Informed and Advocate for Change**: Keeping abreast of the latest developments and changes in student loan policies can equip students with the knowledge needed to make informed decisions. Additionally, advocating for policy changes that address the student loan debt crisis can contribute to broader systemic solutions.

In conclusion, managing and reducing student loan debt requires a multifaceted approach that combines strategic planning, financial literacy, and proactive advocacy. By implementing the strategies outlined in this guide, students can take control of their financial future, reducing the burden of student loan debt and paving the way for a more secure and prosperous future.