Understanding Loan Origination: The Definitive Guide to Securing Your Next Mortgage

Loan origination is a critical process that sets the foundation for obtaining any kind of loan, including mortgages, auto loans, and personal loans. For tho……

Loan origination is a critical process that sets the foundation for obtaining any kind of loan, including mortgages, auto loans, and personal loans. For those looking to secure their next mortgage, understanding the intricacies of loan origination can make the difference between a smooth and successful application and a frustrating and ultimately unsuccessful one.

At its core, loan origination is the process through which a lender evaluates and approves a borrower's application for a loan. This multifaceted process involves several key steps, each designed to ensure that the lender can assess the borrower's creditworthiness, financial stability, and ability to repay the loan.

The first step in loan origination is typically the borrower's application. This application will require the borrower to provide detailed financial information, including income, employment history, and debt obligations. The lender will use this information to evaluate the borrower's creditworthiness, which is a measure of their ability to repay the loan.

Once the application has been submitted, the lender will conduct a credit check. This involves reviewing the borrower's credit report and credit score, which are indicators of their financial history and creditworthiness. The lender will also assess the borrower's employment history and income to determine their ability to repay the loan.

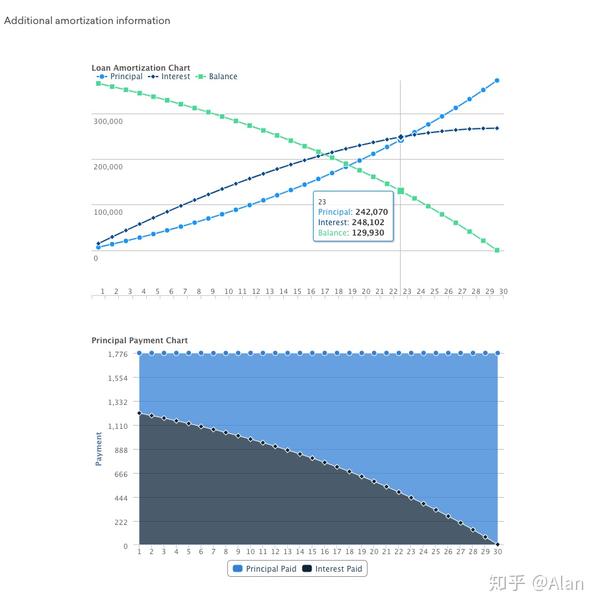

If the lender is satisfied with the borrower's creditworthiness and financial stability, they will proceed with the loan origination process. This involves negotiating the terms of the loan, including the interest rate, loan amount, and repayment schedule. The lender will also require the borrower to provide collateral, such as a home or car, to secure the loan.

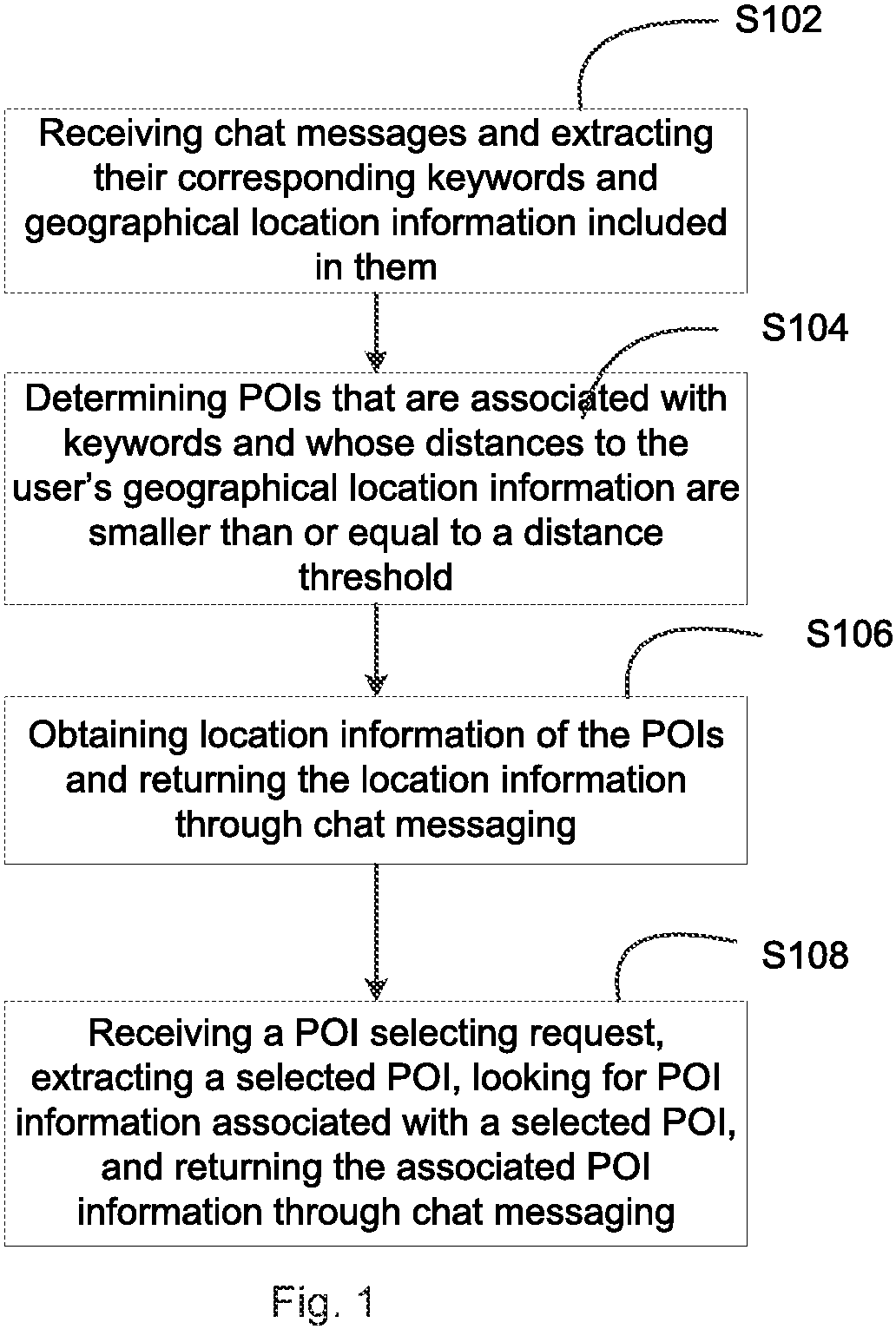

Once the terms of the loan have been agreed upon, the lender will prepare the loan documents and submit them to the underwriting department for approval. Underwriting is the process of reviewing the loan application and documents to ensure that the loan meets the lender's criteria for approval. This includes verifying the borrower's financial information and assessing the loan's risk.

If the loan is approved, the lender will proceed with funding the loan. This involves transferring the loan funds to the borrower's account or disbursing them to the seller or vendor on their behalf.

In conclusion, loan origination is a complex process that involves several key steps. By understanding the intricacies of this process, borrowers can better prepare for the loan origination process and increase their chances of securing a successful loan. Whether you're looking to secure a mortgage, auto loan, or personal loan, understanding the loan origination process is essential to achieving your financial goals.