How Long to Pay Off Home Loan Calculator: A Comprehensive Guide to Your Mortgage Timeline

Guide or Summary:Home LoanHow Long to Pay Off Home LoanFactors Influencing Your Home Loan TimelineHow Long to Pay Off Home Loan Calculator: BenefitsHome Loa……

Guide or Summary:

- Home Loan

- How Long to Pay Off Home Loan

- Factors Influencing Your Home Loan Timeline

- How Long to Pay Off Home Loan Calculator: Benefits

Home Loan

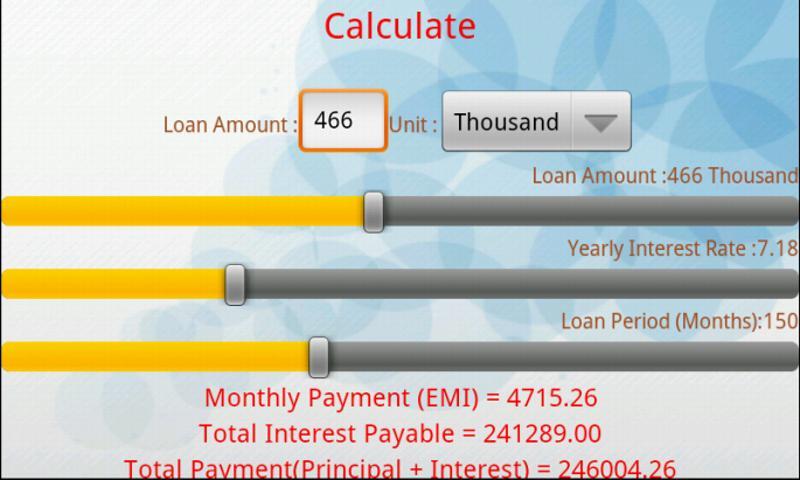

A home loan is a long-term financial commitment that can significantly impact your financial health. It's crucial to understand the timeline of your mortgage to make informed decisions about your finances. This comprehensive guide, complete with a detailed how long to pay off home loan calculator, will help you navigate your mortgage timeline, making it easier to plan for the future.

How Long to Pay Off Home Loan

The length of time it takes to pay off a home loan varies depending on several factors, including the type of mortgage you have, the interest rate, and the amount of your monthly payments. To determine how long you will pay off your home loan, you'll need to consult a how long to pay off home loan calculator. This tool will take into account your mortgage details, such as the principal amount and the interest rate, to provide you with an accurate timeline.

Factors Influencing Your Home Loan Timeline

Several factors can impact the timeline of your home loan, including:

How Long to Pay Off Home Loan Calculator: Benefits

Using a how long to pay off home loan calculator can provide several benefits, including:

Understanding the timeline of your home loan is essential for making informed financial decisions. By using a how long to pay off home loan calculator, you can gain a clear understanding of your mortgage timeline, factoring in variables such as the type of mortgage, interest rate, loan amount, and monthly payment. This information can help you make informed decisions about your finances and plan for the future. Whether you're just starting your mortgage journey or looking to refinance, a how long to pay off home loan calculator can provide valuable insights into your mortgage timeline.