"Calculate Interest on Loan Excel: A Simple Guide to Financial Planning"

3

0

Guide or Summary:ExcelExcel is a powerful software tool that has revolutionized the way we handle and analyze data. Whether you're a business owner, a stude……

Guide or Summary:

- ExcelExcel is a powerful software tool that has revolutionized the way we handle and analyze data. Whether you're a business owner, a student, or an individual looking to manage your finances, Excel offers a wide range of features and functions that can help you achieve your goals. One of the most useful features of Excel is its ability to calculate interest on loans, making it an essential tool for anyone looking to plan their finances effectively.

- CalculateCalculating interest on a loan is a crucial step in financial planning. It helps you understand the true cost of borrowing money and make informed decisions about your finances. With Excel, calculating interest on a loan is easier than ever before. Whether you're looking to take out a mortgage, a car loan, or a personal loan, Excel can help you calculate the interest rate, the total amount of interest you'll pay over the life of the loan, and the monthly payments you'll need to make.

- InterestInterest is the cost of borrowing money. It's the fee you pay to a lender for the use of their funds. Understanding interest rates is essential when it comes to financial planning. With Excel, you can easily calculate the interest rate on a loan and understand how it affects your monthly payments and the total amount of interest you'll pay over the life of the loan.

- LoanA loan is a type of financial agreement in which you borrow money from a lender and agree to repay the loan with interest over a specified period of time. Loans are used for a variety of purposes, including buying a home, starting a business, or paying for education. Understanding how to calculate the interest on a loan is essential when it comes to making informed financial decisions.

- ExcelExcel is a powerful tool that can help you calculate the interest on a loan. With Excel, you can create a simple spreadsheet that includes all the necessary information about your loan, such as the loan amount, the interest rate, and the term of the loan. You can then use Excel's built-in functions to calculate the interest rate, the total amount of interest you'll pay over the life of the loan, and the monthly payments you'll need to make.

- Calculate Interest on Loan ExcelCalculating interest on a loan using Excel is a straightforward process. You can use Excel's built-in functions, such as the PMT function, to calculate the monthly payments you'll need to make on your loan. You can also use Excel's built-in functions to calculate the total amount of interest you'll pay over the life of the loan. By using Excel to calculate the interest on a loan, you can make informed financial decisions and plan your finances more effectively.

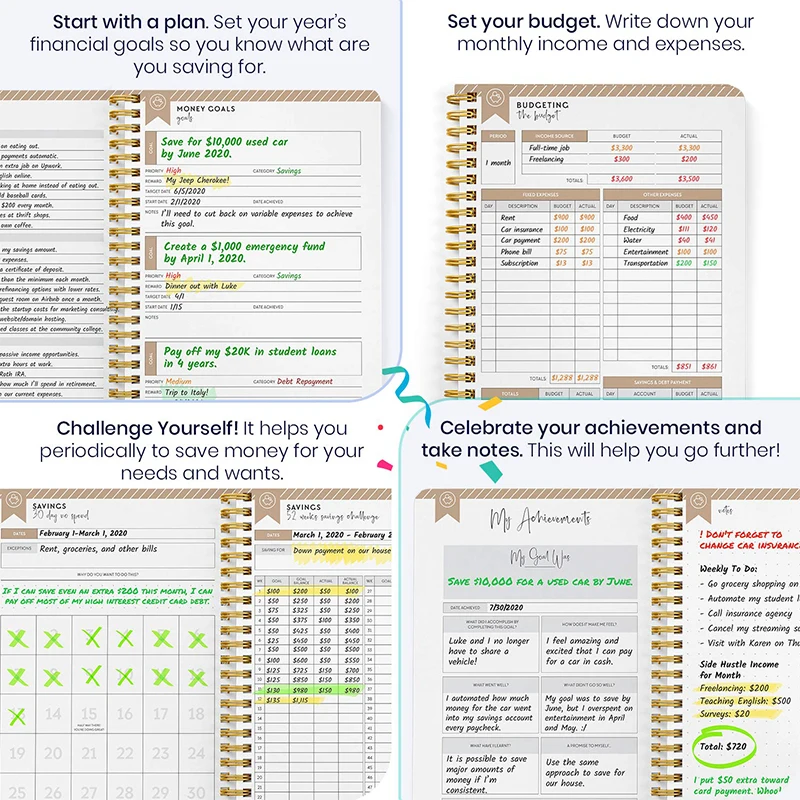

- Financial PlanningFinancial planning is the process of making informed decisions about your finances. It involves setting financial goals, creating a budget, and making strategic financial decisions that will help you achieve your goals. Calculating interest on a loan using Excel is an essential part of financial planning. It helps you understand the true cost of borrowing money and make informed decisions about your finances.

- ExcelExcel is a powerful tool that can help you plan your finances more effectively. With Excel, you can create a simple spreadsheet that includes all the necessary information about your loan, such as the loan amount, the interest rate, and the term of the loan. You can then use Excel's built-in functions to calculate the interest rate, the total amount of interest you'll pay over the life of the loan, and the monthly payments you'll need to make.

- ExcelExcel is a powerful tool that can help you plan your finances more effectively. With Excel, you can create a simple spreadsheet that includes all the necessary information about your loan, such as the loan amount, the interest rate, and the term of the loan. You can then use Excel's built-in functions to calculate the interest rate, the total amount of interest you'll pay over the life of the loan, and the monthly payments