Discover the Benefits of Helpc Loan: Your Ultimate Guide to Financial Freedom

Guide or Summary: Flexible Loan Amounts Competitive Interest Rates Quick Approval Process Versatile Use of Funds Improved Credit ScoreStep 1: Assess Your Fi……

Guide or Summary:

- Flexible Loan Amounts

- Competitive Interest Rates

- Quick Approval Process

- Versatile Use of Funds

- Improved Credit Score

- Step 1: Assess Your Financial Needs

- Step 2: Research Lenders

- Step 3: Gather Necessary Documentation

- Step 4: Complete the Application

- Step 5: Review Loan Terms

- Step 6: Receive Your Funds

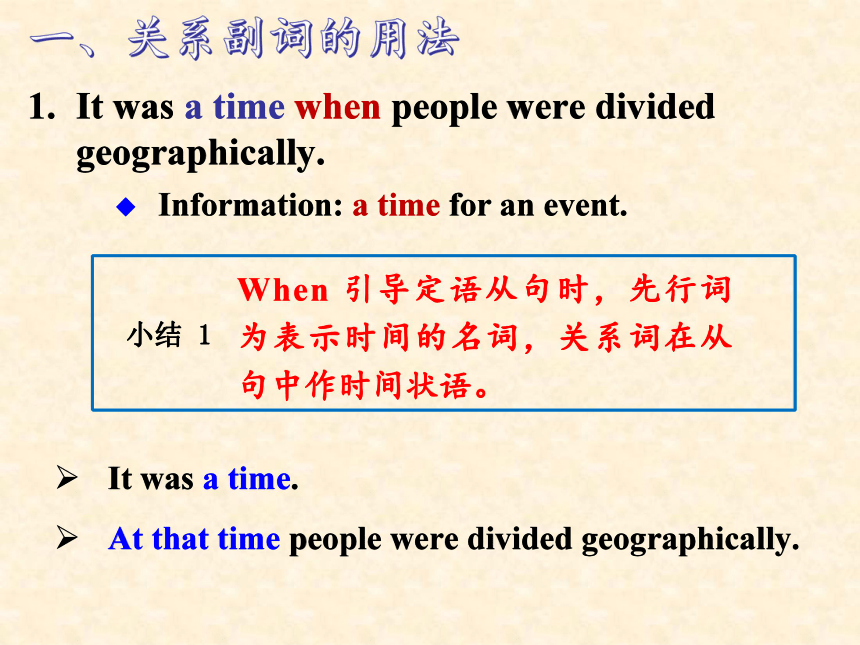

#### What is Helpc Loan?

The term "helpc loan" refers to a financial product designed to assist individuals in need of funds for various purposes, such as education, home improvement, or unexpected expenses. These loans are often characterized by their flexible repayment terms and competitive interest rates, making them an attractive option for many borrowers.

#### Why Choose Helpc Loan?

When considering a loan, it’s essential to evaluate your options carefully. Here are several compelling reasons why a heloc loan may be the right choice for you:

1. Flexible Loan Amounts

Helpc loans typically allow borrowers to choose the amount they need, which can range from a few hundred to several thousand dollars. This flexibility enables individuals to tailor their borrowing to meet specific financial needs without overextending themselves.

2. Competitive Interest Rates

One of the significant advantages of heloc loans is their competitive interest rates. Compared to credit cards or personal loans, heloc loans often offer lower rates, which can save borrowers a considerable amount of money over time.

3. Quick Approval Process

In today’s fast-paced world, waiting weeks for loan approval can be frustrating. Helpc loans often have a streamlined application process, allowing borrowers to receive funds quickly, sometimes within just a few days.

4. Versatile Use of Funds

Helpc loans can be used for various purposes, from consolidating debt to financing a home renovation or covering unexpected medical expenses. This versatility makes them a popular choice for many individuals.

5. Improved Credit Score

Responsible borrowing and timely repayment of a heloc loan can positively impact your credit score. By demonstrating your ability to manage debt effectively, you can improve your creditworthiness for future financial opportunities.

#### How to Apply for a Helpc Loan

Applying for a heloc loan is generally straightforward. Here’s a step-by-step guide to help you through the process:

Step 1: Assess Your Financial Needs

Before applying, take the time to evaluate how much money you need and for what purpose. This assessment will help you choose the right loan amount and type.

Step 2: Research Lenders

Not all lenders offer the same terms and conditions. Research various financial institutions, credit unions, and online lenders to find the best heloc loan options available.

Step 3: Gather Necessary Documentation

Most lenders will require documentation such as proof of income, credit history, and identification. Having these documents ready will expedite the application process.

Step 4: Complete the Application

Fill out the application form provided by your chosen lender. Ensure that all information is accurate to avoid delays in approval.

Step 5: Review Loan Terms

Once approved, carefully review the loan terms, including interest rates, repayment schedules, and any fees associated with the loan. Make sure you understand your obligations before signing.

Step 6: Receive Your Funds

After signing the agreement, the lender will disburse the funds, usually through direct deposit or a check. You can then use the money for your intended purpose.

#### Conclusion

Helpc loans present a viable solution for individuals seeking financial assistance. With their flexible terms, competitive rates, and quick approval processes, they can help you achieve your financial goals while maintaining peace of mind. Remember to conduct thorough research and choose a reputable lender to ensure a smooth borrowing experience. Whether you’re looking to consolidate debt, fund a significant purchase, or cover unexpected expenses, a heloc loan could be the key to unlocking your financial freedom.