"Unlock Your Dream Home: How to Use the 30 Year Loan Mortgage Calculator for Financial Success"

#### IntroductionIn today's real estate market, purchasing a home is one of the most significant financial decisions you will ever make. Understanding the f……

#### Introduction

In today's real estate market, purchasing a home is one of the most significant financial decisions you will ever make. Understanding the financial implications of a mortgage is crucial, and that's where the 30 year loan mortgage calculator comes into play. This tool can help you visualize your monthly payments, interest costs, and the overall impact on your financial future.

#### What is a 30 Year Loan Mortgage Calculator?

A 30 year loan mortgage calculator is an online tool designed to help prospective homebuyers estimate their monthly mortgage payments based on the loan amount, interest rate, and loan term. The 30-year term is one of the most popular options for home loans, providing a balance between manageable monthly payments and the total interest paid over the life of the loan.

#### How Does It Work?

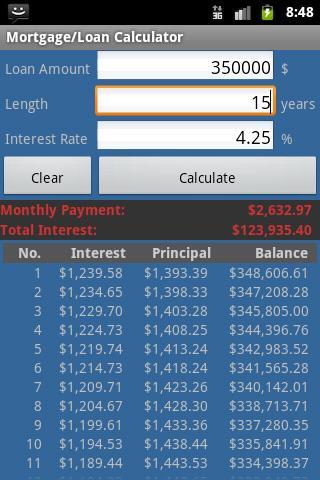

Using a 30 year loan mortgage calculator is straightforward. You simply input the following information:

1. **Loan Amount**: The total amount you plan to borrow.

2. **Interest Rate**: The annual interest rate offered by your lender.

3. **Loan Term**: In this case, you will select 30 years.

Once you input this data, the calculator will provide you with an estimated monthly payment, total interest paid over the life of the loan, and the total amount paid (principal plus interest).

#### Benefits of Using a 30 Year Loan Mortgage Calculator

1. **Budgeting**: Knowing your monthly payment helps you budget better and understand what you can afford.

2. **Comparing Loan Options**: You can easily compare different loan amounts and interest rates to see how they affect your monthly payment.

3. **Financial Planning**: It allows you to plan your finances better, including how much you need to save for a down payment and other costs associated with buying a home.

#### Factors to Consider

While a 30 year loan mortgage calculator provides valuable insights, it’s essential to consider other factors:

- **Property Taxes**: These can significantly affect your monthly payment.

- **Homeowners Insurance**: This is another cost that should be factored into your budget.

- **Private Mortgage Insurance (PMI)**: If your down payment is less than 20%, you may be required to pay PMI, which can increase your monthly payment.

#### Conclusion

In conclusion, the 30 year loan mortgage calculator is an invaluable tool for anyone looking to buy a home. It empowers you with knowledge about your potential mortgage payments, helping you make informed decisions. By understanding how to use this calculator effectively, you can take significant strides towards homeownership and financial stability. Whether you're a first-time homebuyer or looking to refinance, leveraging this tool can set you on the right path toward achieving your real estate dreams.