"Understanding Loan Rate Mortgage: How to Secure the Best Rates for Your Home Loan"

#### Loan Rate MortgageWhen it comes to purchasing a home, one of the most significant factors to consider is the loan rate mortgage. This term refers to th……

#### Loan Rate Mortgage

When it comes to purchasing a home, one of the most significant factors to consider is the loan rate mortgage. This term refers to the interest rate applied to a mortgage loan, which can greatly impact your monthly payments and the overall cost of your home over time. Understanding how loan rates work and what influences them is essential for any prospective homeowner.

#### What is a Loan Rate Mortgage?

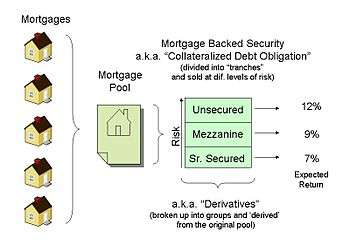

A loan rate mortgage is essentially the cost of borrowing money to buy a home, expressed as a percentage of the loan amount. The rate can be fixed, meaning it remains the same throughout the life of the loan, or variable, where it can change based on market conditions. Knowing the difference between these types of rates is crucial when deciding on the best mortgage option for your financial situation.

#### Factors Influencing Loan Rates

Several factors can influence the loan rate mortgage you receive. These include:

1. **Credit Score**: Lenders assess your creditworthiness through your credit score. A higher score typically results in lower interest rates, while a lower score can lead to higher rates.

2. **Loan Type**: Different types of loans, such as conventional, FHA, or VA loans, come with varying interest rates. It’s essential to research which type best suits your needs.

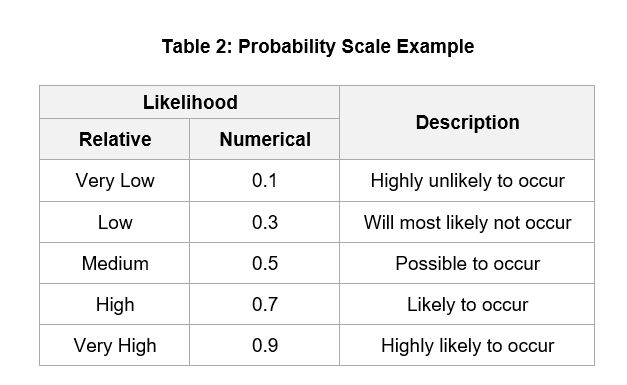

3. **Market Conditions**: Loan rates are influenced by the broader economic environment. When the economy is strong, rates may rise, while they may decrease during economic downturns.

4. **Down Payment**: The amount you put down upfront can also affect your loan rate. A larger down payment often leads to lower rates, as it reduces the lender's risk.

5. **Loan Term**: The length of the loan can impact the rate. Typically, shorter-term loans have lower rates compared to longer-term loans, but they come with higher monthly payments.

#### How to Secure the Best Loan Rate Mortgage

Securing the best loan rate mortgage involves several strategic steps:

1. **Improve Your Credit Score**: Before applying for a mortgage, check your credit report and work on improving your score. Pay down debts, make payments on time, and avoid taking on new debt.

2. **Shop Around**: Different lenders offer varying rates. It’s crucial to compare offers from multiple lenders to find the best deal. Don’t hesitate to negotiate for better terms.

3. **Consider Timing**: Loan rates can fluctuate based on economic conditions. Keep an eye on market trends and consider locking in a rate when they are low.

4. **Choose the Right Loan Type**: Evaluate the different types of mortgages available and choose one that aligns with your financial goals and situation.

5. **Make a Larger Down Payment**: If possible, aim to make a larger down payment. This not only lowers your loan amount but can also help you secure a better interest rate.

#### Conclusion

In conclusion, understanding the concept of loan rate mortgage is vital for anyone looking to buy a home. By taking the time to educate yourself about how loan rates work and what factors influence them, you can make informed decisions that will save you money in the long run. Remember to improve your credit score, shop around for the best rates, and consider your options carefully. With the right approach, you can secure a favorable loan rate mortgage that fits your financial needs.