"Navigating Unemployed Student Loans: Essential Strategies for Financial Relief"

---#### Understanding Unemployed Student LoansUnemployed student loans refer to the financial obligations that students must manage after graduation, especi……

---

#### Understanding Unemployed Student Loans

Unemployed student loans refer to the financial obligations that students must manage after graduation, especially when they find themselves without a job. The burden of student debt can be overwhelming, particularly for those who are struggling to secure employment in their field of study. In this article, we will explore the various aspects of unemployed student loans, including repayment options, deferment strategies, and resources available for job-seeking graduates.

#### The Impact of Unemployment on Student Loans

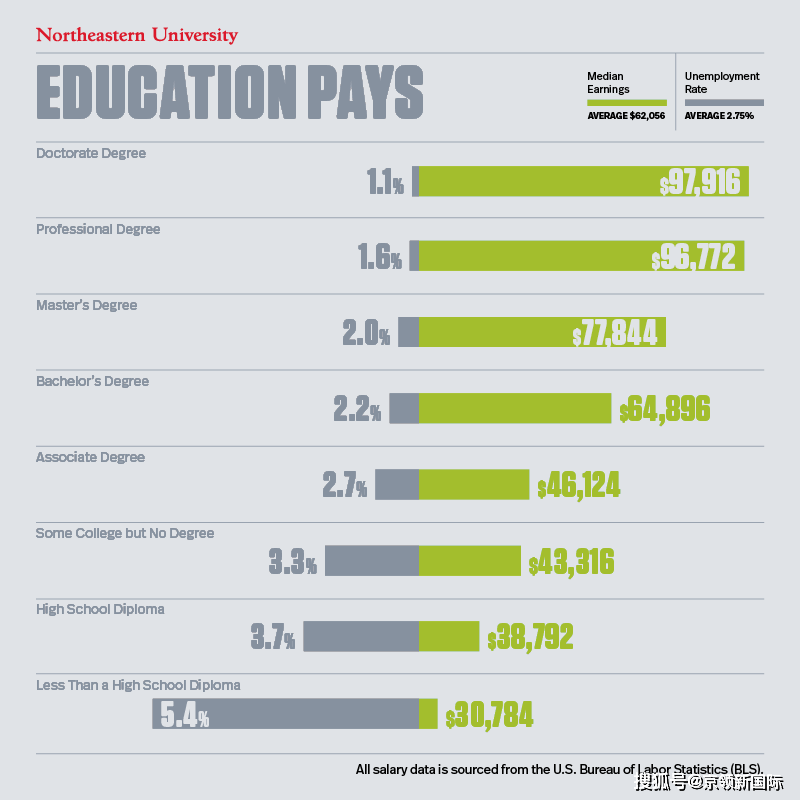

When graduates enter the job market, the reality of unemployment can significantly affect their ability to repay student loans. Many students take on substantial debt to finance their education, often without fully understanding the long-term implications. When faced with unemployment, these loans can become a source of stress and anxiety. It is crucial for graduates to understand their rights and options regarding loan repayment during these challenging times.

#### Repayment Options for Unemployed Graduates

For those struggling to find work, several repayment options exist to ease the financial burden of student loans. Graduates may consider income-driven repayment plans, which adjust monthly payments based on income levels. If a borrower is unemployed or earning a low income, these plans can significantly reduce monthly payments, making it more manageable to stay on top of their loans.

Additionally, graduates can explore the possibility of deferment or forbearance. Deferment allows borrowers to temporarily pause their loan payments, while forbearance provides a short-term relief option for those facing financial hardship. It is important for graduates to communicate with their loan servicers to understand the eligibility requirements and implications of these options.

#### Resources for Unemployed Graduates

Finding employment can be a daunting task, but there are numerous resources available to help unemployed graduates navigate the job market. Career services at universities often provide job placement assistance, resume workshops, and interview preparation. Networking events and job fairs can also open doors to potential employment opportunities.

Online platforms such as LinkedIn, Indeed, and Glassdoor offer job listings and resources for job seekers. Graduates should take advantage of these platforms to connect with employers and explore various job openings. Additionally, professional organizations related to their field of study may offer job boards and networking opportunities.

#### Long-Term Strategies for Managing Student Loans

While the immediate focus for unemployed graduates may be on finding a job, it is essential to develop long-term strategies for managing student loans. Creating a budget that accounts for loan payments, even if they are temporarily paused, can help graduates stay organized and prepared for future financial obligations.

Moreover, graduates should consider seeking financial counseling. Many organizations offer free or low-cost services to help individuals manage their debt and create a sustainable financial plan. By taking proactive steps, unemployed graduates can better position themselves for financial success in the long run.

#### Conclusion

Unemployed student loans can be a significant source of stress for recent graduates. However, understanding the available options for repayment, utilizing resources for job searching, and developing long-term financial strategies can empower graduates to navigate this challenging period. By taking control of their financial situation, unemployed graduates can work towards a brighter future, both professionally and financially.