Unlock Fast Cash with Cash One Title Loans: Your Ultimate Guide to Quick Financing Solutions

Guide or Summary:What are Cash One Title Loans?How Do Cash One Title Loans Work?Benefits of Cash One Title LoansPotential Risks InvolvedHow to Choose the Ri……

Guide or Summary:

- What are Cash One Title Loans?

- How Do Cash One Title Loans Work?

- Benefits of Cash One Title Loans

- Potential Risks Involved

- How to Choose the Right Lender

What are Cash One Title Loans?

Cash One Title Loans are a type of secured loan that allows borrowers to use their vehicle's title as collateral to secure quick cash. This financial product is particularly appealing to individuals who may not have access to traditional bank loans or who need immediate funds for unexpected expenses. By leveraging the equity in their vehicle, borrowers can receive a loan amount that typically ranges from a few hundred to several thousand dollars, depending on the value of the car and the lender's policies.

How Do Cash One Title Loans Work?

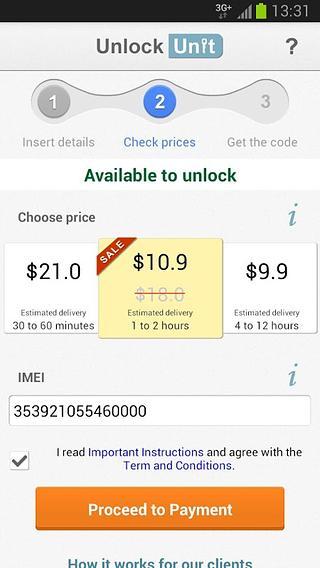

The process of obtaining a Cash One Title Loan is straightforward. First, the borrower must own a vehicle with a clear title. The borrower submits an application that includes details about the vehicle, such as its make, model, year, and mileage. After the lender assesses the vehicle's value, they offer a loan amount based on that value. Once the borrower agrees to the terms, they hand over the vehicle title, and the lender provides the cash. The borrower retains possession of the vehicle while making payments on the loan.

Benefits of Cash One Title Loans

One of the primary benefits of Cash One Title Loans is the speed at which funds can be accessed. Many lenders offer same-day approvals, making it an excellent option for those in urgent need of cash. Additionally, these loans often have fewer qualification requirements compared to traditional loans, making them accessible to a broader range of individuals, including those with less-than-perfect credit histories. Furthermore, since the loan is secured by the vehicle, interest rates can be lower than those associated with unsecured loans.

Potential Risks Involved

While Cash One Title Loans provide quick access to cash, they also come with potential risks. The most significant risk is the possibility of losing the vehicle if the borrower fails to repay the loan on time. Lenders may charge high-interest rates and fees, which can lead to a cycle of debt if the borrower is unable to make payments. It's crucial for borrowers to carefully read the loan agreement and understand the terms before proceeding.

How to Choose the Right Lender

Selecting the right lender for Cash One Title Loans is essential for ensuring a positive borrowing experience. Borrowers should compare interest rates, loan terms, and fees from multiple lenders. Reading customer reviews and checking the lender's reputation with the Better Business Bureau can provide valuable insights. Additionally, it's wise to ask about the lender's policies regarding early repayment and any potential penalties for late payments.

Cash One Title Loans can be a practical solution for individuals facing financial emergencies. By understanding how these loans work, their benefits, and the associated risks, borrowers can make informed decisions. Always conduct thorough research and choose a reputable lender to ensure a smooth borrowing experience. With the right approach, Cash One Title Loans can provide the financial relief needed to navigate unexpected expenses effectively.