Understanding the Impact of Student Loan Debt in America: Challenges and Solutions

#### Student Loan Debt in AmericaStudent loan debt in America has become a significant issue affecting millions of individuals and the broader economy. As o……

#### Student Loan Debt in America

Student loan debt in America has become a significant issue affecting millions of individuals and the broader economy. As of 2023, the total student loan debt in the United States has surpassed $1.7 trillion, making it one of the largest forms of consumer debt in the country. This staggering figure reflects the financial burden that many students and graduates carry as they navigate their post-college lives.

#### The Rise of Student Loan Debt

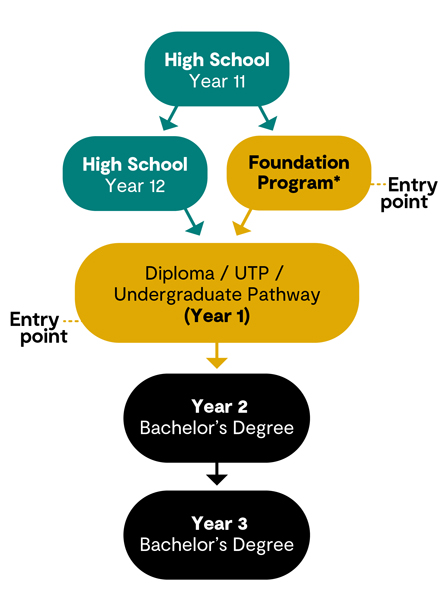

The rise of student loan debt in America can be attributed to several factors. Firstly, the cost of higher education has increased dramatically over the past few decades. Tuition fees at public and private universities have outpaced inflation, leading many students to rely on loans to finance their education. Additionally, the availability of federal and private loans has made it easier for students to borrow large sums of money without fully understanding the long-term implications of their debt.

#### Demographics of Student Loan Borrowers

The demographics of student loan borrowers in America are diverse. While the majority of borrowers are young adults aged 18-29, there is a growing number of older borrowers, including those who returned to school later in life or took out loans for their children's education. Furthermore, disparities exist in the amount of debt taken on by different racial and ethnic groups, with Black and Hispanic borrowers often facing higher levels of debt and lower rates of repayment compared to their White counterparts.

#### The Impact on Individuals

The impact of student loan debt on individuals can be profound. Many graduates find themselves in a position where a significant portion of their income is dedicated to repaying loans, which can hinder their ability to save for a home, invest in retirement, or pursue other financial goals. The stress associated with debt can also affect mental health, leading to anxiety and depression. Moreover, the burden of student loan debt can influence career choices, with some graduates feeling compelled to take higher-paying jobs that may not align with their passions or interests.

#### Economic Consequences

The implications of student loan debt extend beyond individual borrowers; they also have significant economic consequences. High levels of student debt can stifle economic growth by limiting consumer spending. Young adults burdened by debt may delay major life decisions, such as purchasing a home or starting a family. This reluctance to spend can contribute to slower economic recovery and growth.

#### Potential Solutions and Reforms

Addressing the issue of student loan debt in America requires a multifaceted approach. Potential solutions include reforms to the student loan system, such as income-driven repayment plans that adjust monthly payments based on borrowers' earnings. Additionally, increasing funding for grants and scholarships can help reduce reliance on loans. Policymakers are also exploring options for student loan forgiveness, particularly for borrowers in public service roles or those facing financial hardship.

#### Conclusion

In conclusion, student loan debt in America poses significant challenges for individuals and the economy as a whole. As the conversation around student debt continues, it is crucial for stakeholders—students, educators, policymakers, and financial institutions—to work together to find sustainable solutions that will alleviate the burden of debt and promote access to higher education. By addressing the root causes and implementing effective reforms, we can create a more equitable and financially sound future for all students.