Unlock Your Savings: How to Secure Refinance Car Loan Pre Approval for Better Rates

Guide or Summary:Understanding Refinance Car Loan Pre ApprovalBenefits of Getting Pre ApprovedHow to Get Refinance Car Loan Pre ApprovalCommon Mistakes to A……

Guide or Summary:

- Understanding Refinance Car Loan Pre Approval

- Benefits of Getting Pre Approved

- How to Get Refinance Car Loan Pre Approval

- Common Mistakes to Avoid

#### Refinance Car Loan Pre Approval

Refinancing your car loan can be a smart financial move, especially if you’re looking to save money on monthly payments or reduce the overall interest you pay over the life of the loan. One of the first steps in this process is obtaining a **refinance car loan pre approval**. This step not only helps you understand how much you can borrow but also gives you a clearer picture of the interest rates you might qualify for based on your credit profile.

Understanding Refinance Car Loan Pre Approval

When you seek a **refinance car loan pre approval**, lenders will evaluate your credit history, income, and the current value of your vehicle. This process is similar to applying for an initial auto loan but typically requires less documentation. Pre approval indicates that a lender is willing to offer you a loan under certain conditions, which can be a powerful tool in negotiating better terms.

Benefits of Getting Pre Approved

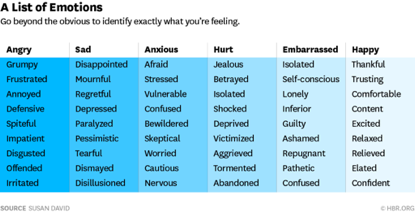

1. **Clarity on Your Financial Situation**: Pre approval provides insight into what you can afford. Knowing your potential loan amount and interest rate helps you make informed decisions.

2. **Stronger Negotiation Power**: Having pre approval gives you leverage when discussing terms with lenders. You can compare offers and choose the best one.

3. **Faster Loan Processing**: With pre approval, the loan processing time is often shorter because much of the groundwork has already been laid.

4. **Improved Interest Rates**: With a solid credit score and a pre approval in hand, you may qualify for lower interest rates, which can significantly reduce your monthly payments and total loan cost.

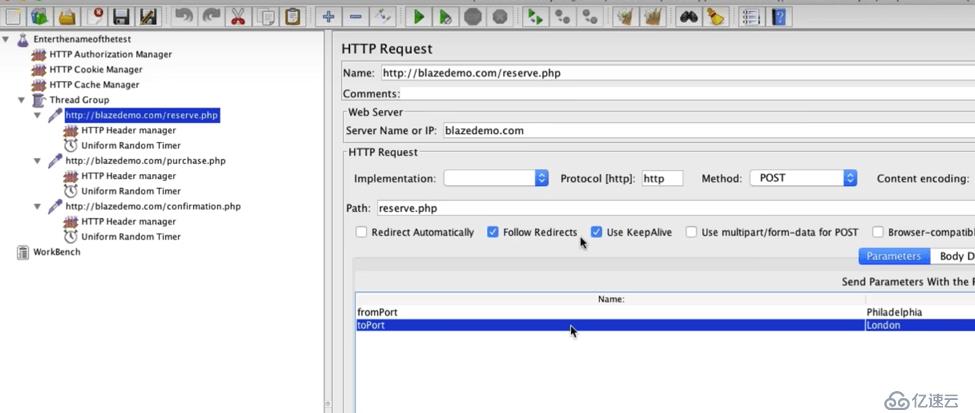

How to Get Refinance Car Loan Pre Approval

To begin the pre approval process, follow these steps:

1. **Check Your Credit Score**: Before applying, review your credit report and score. A higher score typically results in better loan terms.

2. **Gather Necessary Documentation**: Prepare documents such as proof of income, vehicle information, and current loan details. This will streamline the application process.

3. **Research Lenders**: Compare various lenders, including banks, credit unions, and online lenders, to find the best rates and terms for your situation.

4. **Apply for Pre Approval**: Fill out the application with your chosen lender. This may involve a soft credit inquiry, which won’t impact your credit score.

5. **Review Offers**: Once you receive pre approval offers, compare them carefully. Look at interest rates, loan terms, and any fees associated with the loan.

Common Mistakes to Avoid

While seeking a **refinance car loan pre approval**, it’s essential to avoid common pitfalls that could hinder your chances of securing a favorable loan:

- **Neglecting to Shop Around**: Don’t settle for the first offer you receive. Different lenders have varying rates and terms, so it pays to shop around.

- **Ignoring Fees**: Pay attention to any fees associated with the loan, such as origination fees or prepayment penalties, as these can add to your overall cost.

- **Failing to Read the Fine Print**: Always read the terms and conditions carefully before signing. Make sure you understand the implications of the loan agreement.

Obtaining a **refinance car loan pre approval** can be a significant step towards achieving better financial health. By understanding the process, benefits, and potential pitfalls, you can navigate the refinancing landscape more effectively. With the right preparation and research, you can secure a loan that not only meets your needs but also saves you money in the long run. Start your journey today by exploring your refinancing options and take control of your car loan.