Understanding Paycheck Loans: A Comprehensive Guide to Short-Term Financial Solutions

#### What Are Paycheck Loans?Paycheck loans, often referred to as payday loans, are short-term, high-interest loans designed to provide borrowers with quick……

#### What Are Paycheck Loans?

Paycheck loans, often referred to as payday loans, are short-term, high-interest loans designed to provide borrowers with quick cash to cover unexpected expenses until their next paycheck. These loans are typically easy to obtain, requiring minimal documentation and often no credit check, making them an appealing option for individuals facing financial emergencies. However, the convenience of paycheck loans comes with significant risks and costs that borrowers must understand.

#### How Do Paycheck Loans Work?

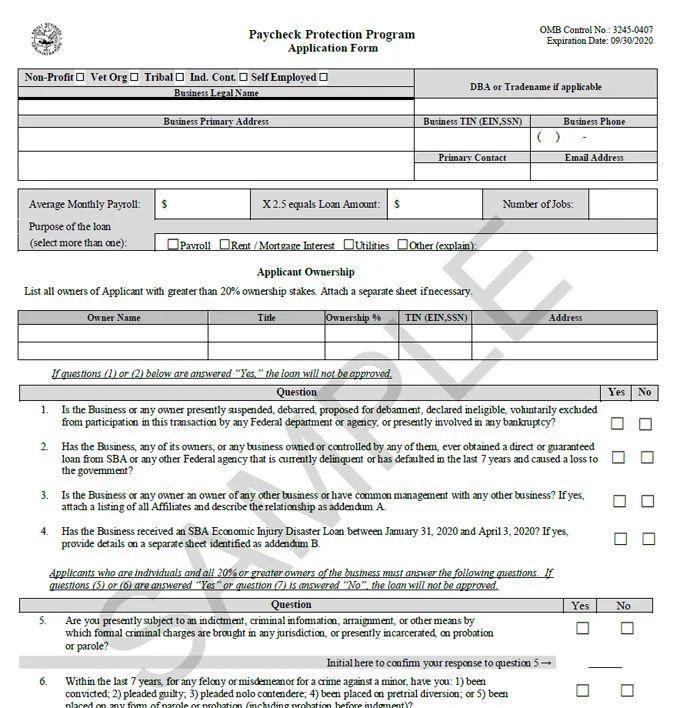

The process of obtaining a paycheck loan is relatively straightforward. Borrowers usually visit a payday loan storefront or apply online, filling out an application that includes personal information and details about their income. Once approved, borrowers can receive cash on the spot or have the funds deposited directly into their bank account.

The loan amount is typically small, ranging from $100 to $1,000, and is expected to be repaid by the borrower’s next payday, hence the name “paycheck loan.” The lender charges a fee for the service, which can translate into an annual percentage rate (APR) that exceeds 400%. This high cost of borrowing can lead to a cycle of debt if borrowers are unable to repay the loan on time.

#### The Pros and Cons of Paycheck Loans

Before deciding to take out a paycheck loan, it’s essential to weigh the pros and cons.

**Pros:**

1. **Quick Access to Cash:** Paycheck loans are designed for immediate financial needs, allowing borrowers to access funds quickly.

2. **Minimal Requirements:** Most lenders do not require a credit check, making it easier for individuals with poor credit to obtain loans.

3. **Convenience:** The application process is often simple and can be completed online or in-person.

**Cons:**

1. **High Interest Rates:** The fees associated with paycheck loans can lead to exorbitant interest rates, making them one of the most expensive forms of borrowing.

2. **Short Repayment Terms:** Borrowers must repay the loan quickly, often within two weeks, which can be challenging if they are already in a tight financial situation.

3. **Risk of Debt Cycle:** Many borrowers find themselves taking out new loans to pay off existing ones, leading to a cycle of debt that can be difficult to escape.

#### Alternatives to Paycheck Loans

For those considering paycheck loans, it’s crucial to explore alternatives that may offer better terms and lower costs. Some options include:

1. **Credit Union Loans:** Many credit unions offer small personal loans with lower interest rates and more flexible repayment terms than payday lenders.

2. **Personal Loans from Banks:** Traditional banks may provide personal loans that can be repaid over a more extended period, making them more manageable.

3. **Payment Plans:** If the financial need arises from a bill or expense, negotiating a payment plan with the creditor may be a viable option.

#### Conclusion

While paycheck loans can provide quick relief in financial emergencies, they come with significant risks and costs that can lead to a cycle of debt. It’s essential for borrowers to thoroughly understand the terms and implications of these loans and to consider alternatives that may provide a more sustainable solution to their financial needs. Always read the fine print and consider seeking advice from financial professionals before committing to any loan.