Can You Get a Home Equity Loan with Bad Credit? Exploring Your Options

Guide or Summary:What is a Home Equity Loan?Can You Get a Home Equity Loan with Bad Credit?Factors Lenders ConsiderOptions for Homeowners with Bad CreditImp……

Guide or Summary:

- What is a Home Equity Loan?

- Can You Get a Home Equity Loan with Bad Credit?

- Factors Lenders Consider

- Options for Homeowners with Bad Credit

- Improving Your Chances

#### Translation: Can you get a home equity loan with bad credit?

When it comes to financing options for homeowners, a home equity loan can be a valuable resource. However, many individuals wonder, "Can you get a home equity loan with bad credit?" This question is crucial for those who may have faced financial difficulties in the past but are looking to tap into the equity of their homes for various purposes, such as home improvements, debt consolidation, or unexpected expenses.

#### Understanding Home Equity Loans

What is a Home Equity Loan?

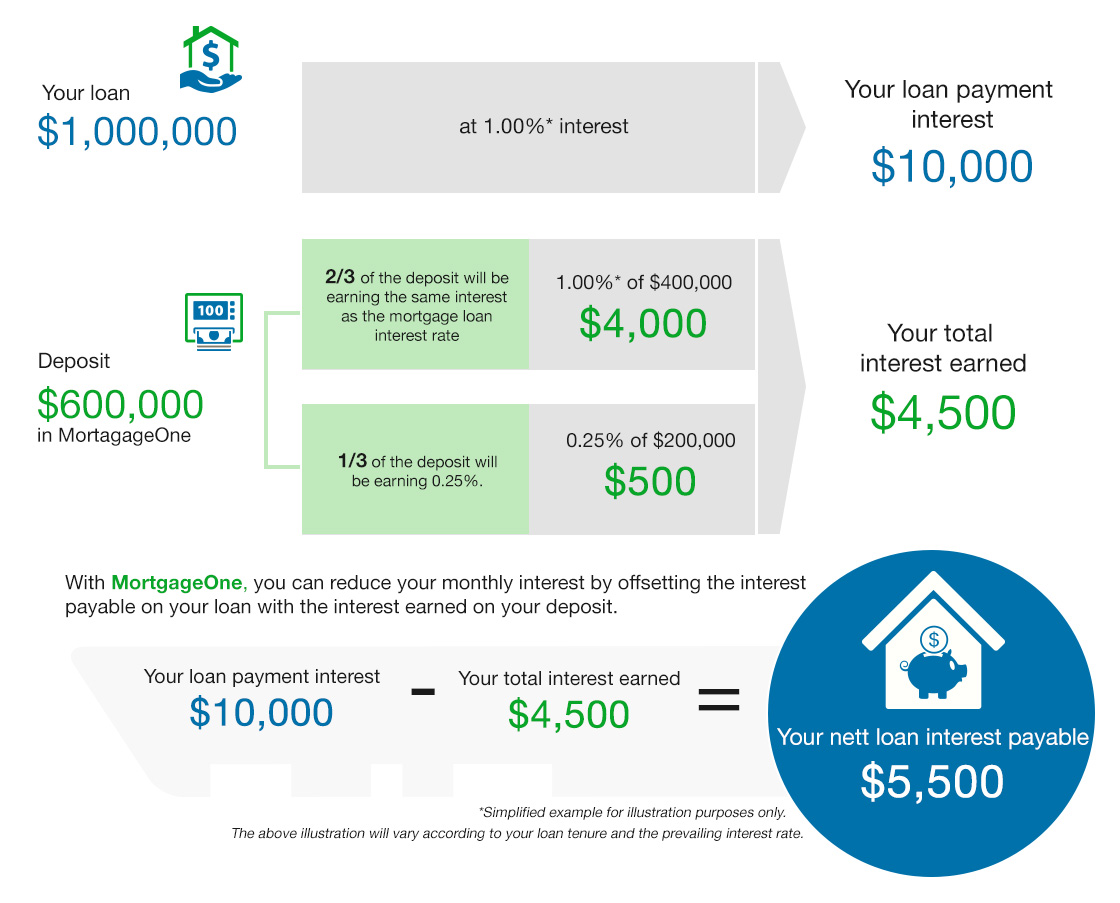

A home equity loan allows homeowners to borrow against the equity they have built up in their property. The equity is the difference between the home's current market value and the outstanding mortgage balance. Home equity loans typically come with fixed interest rates and are paid back over a set term, much like a traditional mortgage. This makes them an attractive option for those looking to access a lump sum of cash.

Can You Get a Home Equity Loan with Bad Credit?

The short answer is yes, it is possible to obtain a home equity loan with bad credit, but it may be more challenging. Lenders typically assess creditworthiness through credit scores, and a lower score may lead to higher interest rates or less favorable loan terms. However, various lenders cater to individuals with less-than-perfect credit, and options do exist.

Factors Lenders Consider

When evaluating a loan application, lenders will consider several factors beyond just credit scores. These include:

1. **Equity in Your Home**: The more equity you have, the better your chances of securing a loan. Lenders generally prefer borrowers with at least 20% equity in their homes.

2. **Debt-to-Income Ratio**: Lenders will look at your monthly debt payments in relation to your income. A lower ratio indicates a better ability to repay the loan.

3. **Employment History**: A stable job and consistent income can help offset a lower credit score.

4. **Loan-to-Value Ratio (LTV)**: This ratio compares the loan amount to the appraised value of the home. A lower LTV can improve your chances of approval.

Options for Homeowners with Bad Credit

If you have bad credit but still wish to pursue a home equity loan, consider the following options:

1. **Credit Unions**: These member-owned institutions often have more flexible lending criteria compared to traditional banks.

2. **Subprime Lenders**: Some lenders specialize in loans for individuals with poor credit. Be cautious, as these loans may come with higher interest rates.

3. **Secured Loans**: Offering additional collateral may help you secure a loan despite a low credit score.

4. **Co-Signer**: Having a co-signer with good credit can improve your chances of approval and potentially lower your interest rate.

Improving Your Chances

To enhance your chances of obtaining a home equity loan with bad credit, consider taking the following steps:

1. **Check Your Credit Report**: Review your credit report for errors and dispute any inaccuracies.

2. **Pay Down Existing Debt**: Reducing your overall debt can improve your debt-to-income ratio and boost your credit score.

3. **Increase Your Income**: A higher income can help offset a lower credit score and demonstrate your ability to repay the loan.

4. **Shop Around**: Different lenders have varying criteria. Comparing offers can help you find the best option for your situation.

In conclusion, while obtaining a home equity loan with bad credit can be challenging, it is not impossible. By understanding the factors that lenders consider and exploring your options, you can increase your chances of securing the financing you need. Always remember to do thorough research and consider consulting with a financial advisor to make the best decision for your financial future.