Understanding the Student Loan Relief Government Programs: What You Need to Know

#### Description:The Student Loan Relief Government programs have become a focal point for many individuals grappling with the burden of student debt. As ed……

#### Description:

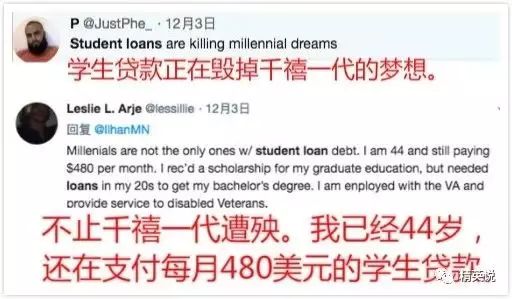

The Student Loan Relief Government programs have become a focal point for many individuals grappling with the burden of student debt. As education costs continue to rise, more borrowers are seeking assistance from the government to alleviate their financial stress. This article aims to provide a comprehensive overview of the various student loan relief government initiatives available, their eligibility criteria, and how they can impact borrowers' financial situations.

In recent years, the U.S. government has introduced several measures aimed at providing relief to student loan borrowers. These programs are designed to ease the financial burden on individuals who have taken out loans to finance their education. The most significant of these initiatives include income-driven repayment plans, loan forgiveness programs, and temporary relief measures enacted in response to economic challenges.

One of the primary forms of student loan relief government offers is income-driven repayment plans. These plans adjust monthly payments based on the borrower’s income and family size, making it more manageable for individuals to keep up with their loan obligations. For example, if a borrower experiences a decrease in income or faces unexpected financial hardships, their monthly payment can be recalibrated, providing immediate relief and preventing default.

Another critical aspect of student loan relief government programs is loan forgiveness. The Public Service Loan Forgiveness (PSLF) program is one of the most well-known initiatives, offering forgiveness for borrowers who work in qualifying public service jobs after making 120 qualifying monthly payments. This program is particularly beneficial for teachers, nurses, and other public sector employees who often carry significant student debt.

Additionally, the government has implemented temporary relief measures, especially in response to the COVID-19 pandemic. During this period, federal student loan payments were paused, and interest rates were set to 0%. This unprecedented action provided much-needed relief to millions of borrowers, allowing them to focus on their financial recovery without the added stress of monthly loan payments.

However, navigating the landscape of student loan relief government programs can be complex. Borrowers must understand the specific requirements and application processes for each program. It’s crucial for individuals to stay informed about changes in legislation and government policies that may affect their eligibility for relief.

Moreover, there are also challenges associated with these relief programs. For instance, many borrowers remain unaware of their options or how to apply for relief. This lack of awareness can lead to missed opportunities for assistance. Additionally, the loan forgiveness process can be lengthy and complicated, often requiring meticulous documentation and compliance with various regulations.

In conclusion, the student loan relief government programs offer essential support to borrowers facing the challenges of student debt. By understanding the available options, individuals can take proactive steps to manage their loans effectively. Whether through income-driven repayment plans, loan forgiveness programs, or temporary relief measures, the government aims to provide a safety net for those striving to achieve financial stability. As policies continue to evolve, staying informed and engaged with these programs is vital for maximizing the benefits available to student loan borrowers.