Discover the Best Loan Rates for Mortgages: Your Ultimate Guide to Affordable Home Financing

Guide or Summary:Understanding the Best Loan Rates for MortgagesWhat Are Mortgage Rates?Factors Influencing the Best Loan Rates for MortgagesHow to Find the……

Guide or Summary:

- Understanding the Best Loan Rates for Mortgages

- What Are Mortgage Rates?

- Factors Influencing the Best Loan Rates for Mortgages

- How to Find the Best Loan Rates for Mortgages

#### Translation of "best loan rates for mortgages": 最佳抵押贷款利率

---

Understanding the Best Loan Rates for Mortgages

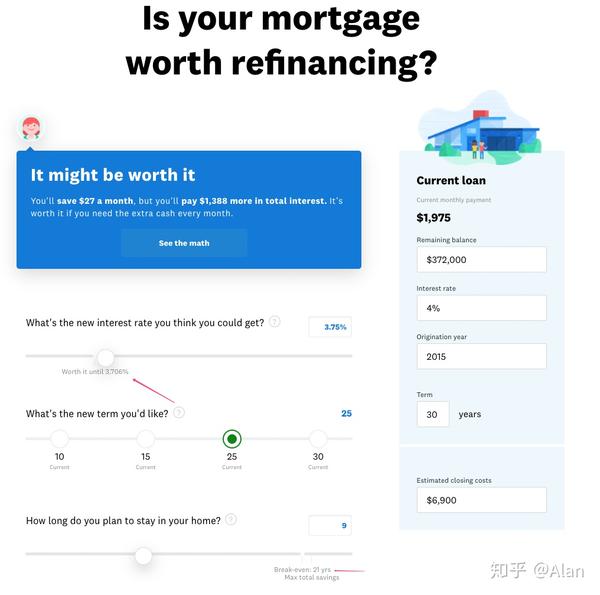

When it comes to buying a home, one of the most crucial factors to consider is the mortgage rate. The best loan rates for mortgages can significantly impact your monthly payments and the overall cost of your home. In this guide, we will explore what these rates are, how they are determined, and tips on securing the most favorable rates.

What Are Mortgage Rates?

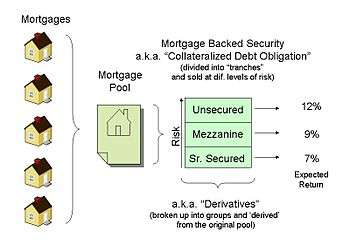

Mortgage rates are the interest rates charged on a mortgage loan. They can be fixed or variable. A fixed-rate mortgage maintains the same interest rate throughout the loan term, making it easier for homeowners to budget their monthly payments. In contrast, a variable-rate mortgage may change over time, potentially leading to higher payments in the future.

Factors Influencing the Best Loan Rates for Mortgages

Several factors influence the best loan rates for mortgages. These include:

1. **Credit Score**: Lenders use your credit score to gauge your creditworthiness. A higher score typically leads to lower rates.

2. **Loan Amount**: The size of the loan can affect the rate. Larger loans may have slightly higher rates due to the increased risk for lenders.

3. **Down Payment**: A larger down payment can lower your mortgage rate. It shows the lender that you are financially stable and reduces their risk.

4. **Loan Type**: Different types of loans (e.g., FHA, VA, conventional) come with varying rates. Researching the best options for your situation is essential.

5. **Market Conditions**: Economic factors, such as inflation and the Federal Reserve's interest rate decisions, can influence mortgage rates.

How to Find the Best Loan Rates for Mortgages

Finding the best loan rates for mortgages requires some research and preparation. Here are some steps you can take:

1. **Shop Around**: Don’t settle for the first offer. Compare rates from multiple lenders to ensure you are getting the best deal.

2. **Check Your Credit Report**: Review your credit report for errors and ensure your credit score is as high as possible before applying for a mortgage.

3. **Consider Different Loan Types**: Explore various loan products to find one that meets your needs and offers competitive rates.

4. **Get Pre-approved**: Pre-approval can give you a better idea of the rates you qualify for and strengthen your position when negotiating with sellers.

5. **Negotiate with Lenders**: Don’t be afraid to ask lenders for better rates or terms. They may be willing to work with you to secure your business.

Securing the best loan rates for mortgages can save you thousands of dollars over the life of your loan. By understanding the factors that influence mortgage rates and taking proactive steps to improve your financial standing, you can position yourself to get the best possible deal. Remember, the key to successful home financing is thorough research and preparation. Happy house hunting!