Understanding Interest Capitalization on Student Loans: What Borrowers Need to Know

#### Interest CapitalizationInterest capitalization refers to the process where unpaid interest on a loan is added to the principal balance. This can occur……

#### Interest Capitalization

Interest capitalization refers to the process where unpaid interest on a loan is added to the principal balance. This can occur during various stages of a loan, particularly with student loans. When interest is capitalized, it increases the total amount owed, which can lead to higher monthly payments and more interest accrued over time. Understanding how interest capitalization works is crucial for borrowers, especially students who are navigating their financial futures.

#### Student Loans

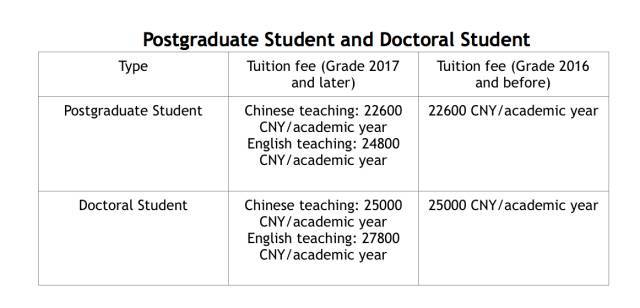

Student loans are financial aid options that help students pay for their education. They can come from the federal government or private lenders. Federal student loans often have lower interest rates and more flexible repayment options compared to private loans. However, regardless of the source, understanding the terms and conditions, including interest capitalization, is vital for managing debt effectively.

### Detailed Description

When students take out loans to finance their education, they often focus on tuition costs, living expenses, and other immediate financial needs. However, one critical aspect that many borrowers overlook is the concept of interest capitalization, particularly in relation to student loans.

Interest capitalization typically occurs under specific circumstances, such as when a borrower enters repayment after a deferment or forbearance period, or when they graduate. During these periods, interest may accumulate, and if it is not paid, it will be added to the principal balance of the loan. This means that future interest calculations will be based on a higher amount, leading to increased costs over the life of the loan.

For example, consider a student loan with an initial balance of $10,000 and an interest rate of 5%. If the student does not make interest payments during a six-month grace period after graduation, the interest that accrues (approximately $250) will be added to the principal. As a result, the new balance will be $10,250, and future interest will be calculated on this increased amount, leading to higher total repayments.

#### Implications of Interest Capitalization

The implications of interest capitalization can be significant. Borrowers may find themselves in a cycle of debt that is difficult to escape. Higher principal balances lead to higher monthly payments, which can strain a recent graduate’s budget. Additionally, as interest continues to accrue on the larger principal, the total cost of the loan can escalate quickly.

To mitigate the effects of interest capitalization, borrowers should consider making interest payments while still in school or during deferment periods. This proactive approach can prevent interest from being added to the principal balance and can save borrowers a considerable amount of money over the life of their loans.

#### Strategies for Managing Student Loan Debt

Understanding interest capitalization is just one piece of the puzzle when it comes to managing student loans. Here are some strategies that borrowers can employ:

1. **Stay Informed**: Borrowers should read and understand the terms of their loan agreements, including how and when interest capitalization occurs.

2. **Make Payments During School**: If possible, making interest payments while still in school can prevent capitalization and keep the principal balance lower.

3. **Consider Repayment Plans**: Federal student loans offer various repayment plans, including income-driven repayment options that can make monthly payments more manageable.

4. **Refinance If Possible**: For borrowers with private loans or those who may qualify for lower interest rates, refinancing can be an option to reduce monthly payments and total interest paid.

5. **Seek Financial Counseling**: Many institutions offer financial counseling services that can help borrowers create a plan for managing their debt.

In conclusion, understanding interest capitalization on student loans is essential for borrowers to make informed financial decisions. By being proactive and knowledgeable about how interest accrues and capitalizes, students can better manage their loans and work towards a financially stable future.